Dear Comrades,

100 trials for 100 days at $100 offers are going fast, there are still 54 available—see offer details and sign up process, not available online. Our first sign up was Anthony E who will also receive a free signed copy of “The Crisis of Democratic Capitalism” by Martin Wolf.

Sorry, no institutional/enterprise offering

A couple of portfolio managers at a large multi-strat hedge fund have requested a firmwide trial membership. Unfortunately, the answer is still ‘No'. The reasons are as follows:

– Our content licensing agreements are for non-enterprise individual customers only. At present, we do not have the bandwidth to provide institutional clients with the high-quality service they deserve. Nor would we recommend replacing a high-touch client relationship for those that have the budget. A good client relationship is about more than access to research reports, and we like to encourage that.

– Going forward, our focus is to provide useful technologies for our members to curate content to their individual interests.

– We don't wish to become pseudo-therapists and listen to egotistical fund managers caught on the wrong side of day-to-day market moves… “It's okay, it's not your fault it happened. It could have happened to anyone, but it keeps happening to you.” Listening to friends and former colleagues complain is already enough.

– Given the tight stop-losses at some funds, there's a high chance of being let go before the trial period lapses. Then we will be asked to make introductions to help people find a new job. 🙂

Hopefully, that clears things up a bit. Otherwise, everyone is welcome to take the trial offer regardless of their employment circumstances. Partner, academics and policymakers will receive separate complimentary logins.

Thank you to all those who have already signed up, and welcome aboard!

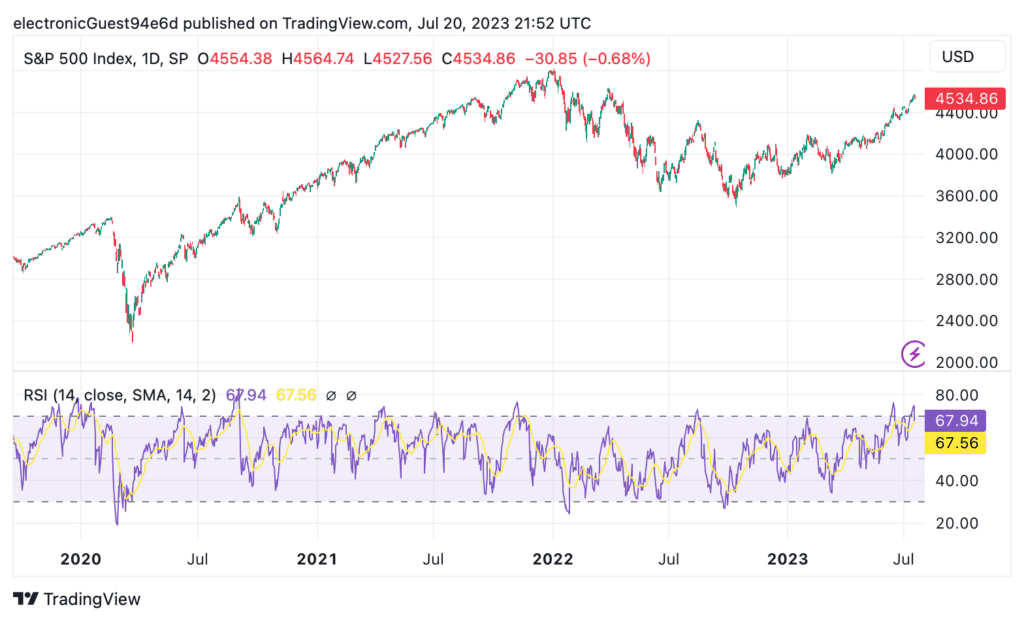

Equities tug of war

In the tug of war on the S&P 500 with: upside risk from a potential China stimulus announcement and downside (risk) according to momentum indicators (overbought), the latter has prevailed. As we said yesterday, it is more likely that the previous days' buyers acted from a position weakness rather than strength—forced buyers of risk assets.