Download PDF

We are at a pivotal moment in the history of TIM, a moment where critical business and capital allocation decisions will define the future of our company and its stakeholders, of its employees, its suppliers and the digitalisation of Italy.

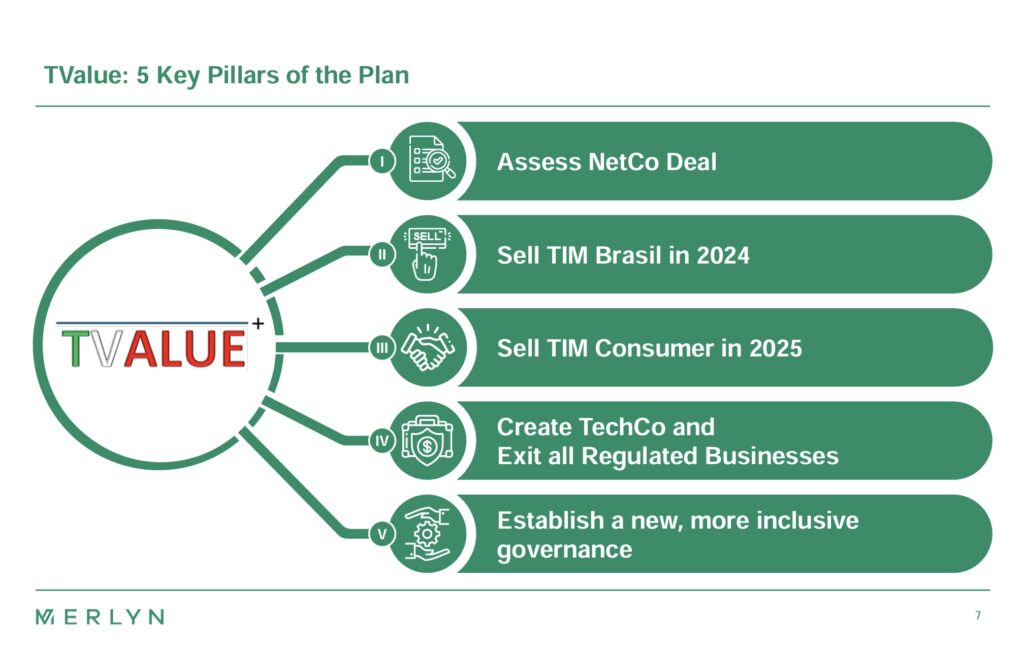

Over the course of the last few months, we worked on an effective and executable business plan for the relaunch of TIM that we named TValue.

On 27 October 2023, we presented TValue to TIM's Board of Directors as a possible alternative for the company. TIM’s Board of Directors dismissed our ideas and pressed ahead with a plan that we thought was unclear and not financially sustainable (at least not on its own). The market has subsequently expressed our same opinion on the company’s plan that led to even more significant losses for shareholders.

The sale of NetCo on its own is not enough to guarantee a sustainable future to TIM and any delay to the actual closing, in the absence of other measures, would be financially devastating for the company.

Once more clarity emerged on the scope of the network perimeter of NetCo, TValue is comfortable that our plan would not be jeopardised by its sale and we can therefore commit to successfully executing the sale of NetCo to KKR as quickly as possible and facilitating the merger of NetCo with OpenFiber.

NetCo successful sale to KKR as soon as possible – hopefully by summer 2024 as currently planned – will therefore be our immediate priority.

At the same time, TValue is strongly convinced that relying exclusively on the NetCo sale as a solution to the excessive debt burden and lack of profitability of the company has 2 big problems. A business one: TIM is no longer in a position to successfully invest and compete in the retail space and remaining in it will constantly be a drag to the company’s performance. And more importantly a financial one: being the only avenue pursued to reduce debt, it leaves the company exposed to enormous risks in case of any delay to its closing given the Euro 125mm per month impact to free cash flows.

To eliminate any financial risk and have the resources to invest in the high growth Tech & Infra business dedicated to Business and Public Administration clients, where TIM has a competitive advantage and can become a European leader, TValue will divest from businesses lacking competitive advantages (such as retail) and non-core operations (Brazil).

MAIN POINTS OF THE TVALUE PLAN

- Pacta sunt servanda: our immediate priority will be to successfully execute the sale of NetCo to KKR as soon as possible (hopefully by summer 2024 as currently planned). Facilitate the merger of NetCo with OpenFiber to create a much-needed National Grid and ensure the earn-out. TValue’s original plan was to preserve TIM’s network integrity, engaging KKR as a shareholder of TIM and not as the buyer of TIM’s network. However, differently from what was originally disclosed and after more details emerged on the agreement between TIM and KKR, it is now clear that TIM committed to sell to KKR only its capex intensive last-mile fixed access network rather than its full telecom network. Notably, within the scope of the sale to KKR, TIM is retaining the so called “intelligent network”, including backbone, transport, mobile, platforms, datacentres and what TValue considers the most valuable fixed access connections, those serving strategic Business and Public Administration clients. The sale of NetCo, as currently constructed with such a specific perimeter, has therefore almost no impact on TValue’s original plan of transforming TIM into TechCo, a Tech&Infra company.

- Sell TIM Brasil: the Brazilian business is not core and will be sold within 2024 to promptly reduce the debt burden to a sustainable level and to sustain investments in TechCo and employment in Italy. The immediate sale of TIM Brasil is also a hedge in case of regulatory driven delays in the sale of NetCo (which we believe will be, worst case, completed by the end of 2024).

- Sell TIM Consumer: immediately start conversations to sell TIM’s retail and Italian regulated businesses with a target closing in 2025. This is a business where TIM, despite still enjoying the value of a great brand, has completely lost any competitive advantage. This sale will further boost the growth of TechCo and eliminate a drag to the company’s profitability. The recent bid of Iliad for Vodafone Italy at a multiple of 7.8x EBITDA and the subsequent agreement of Vodafone to enter a sale of Vodafone Italy to Swisscom at an attractive valuation multiple of 7.6x consensus Adjusted EBITDAaL for FY24 is giving us the confidence that, with the correct perimeter, this business can be sold more easily and at better multiples than the market currently prices it. Discussions with potential buyers will start immediately, with the objective of accelerating the process and free up the balance sheet as quickly as possible, but also to ensure that the perimeter restructuring process is aimed at creating the most palatable set of assets based on the desiderata of the potential buyers.

- Create TechCo a high-end tech & infrastructure company uniquely positioned to deliver integrated value-added digital solutions to both Business and Public Administration clients. TechCo, the new TIM post sale of NetCo, TIM Brasil and TIM Consumer will remain a publicly traded company and will be renamed Telecom Italia. TechCo, the heart of the new TIM, will be an Italian company with global ambitions effectively integrating the intelligent network of TIM (the part outside the NetCo/KKR perimeter) with the competencies, knowhow, client relationships, supplier ecosystems, subsidiaries (such as Olivetti, Telsy and Noovle) and the related infrastructure (datacentres and PSN contracts) of TIM Enterprise. This reshaped TIM will exclusively offer non-regulated services. We refer to it as “TechCo” to clearly highlight the new strategic vision of TIM, fully coherent with the sale of NetCo to KKR. Leveraging on the momentum provided by NRRP resources to digitalise Italy, TechCo will become the partner of choice in supporting the Public Administration and Italian companies in their digital transformation. TechCo, thanks to its clear strategic Tech&Infra vision coupled with a clean balance sheet post sale of NetCo, TIM Brasil and TIM Consumer, will act as a market aggregator, moving to the role of predator rather than the one of potential prey in the value-added telco edge space, AI and related computing revolution, cloud, ICT, cybersecurity and IoT. We are deeply convinced TechCo will achieve the right scale and become a European leader in this space. Such transformation will not only create superior value for all shareholders thanks to its cutting-edge added value, higher margins and higher market multiples, but will also support Italy in meeting its digitalisation targets and boost the entire national economic system.

- Foster proper Governance: TValue will foster proper governance within TIM’s Board of Directors to take care of all shareholders, starting from the company’s main shareholders, Vivendi and CDP, always ensuring that the interests of the company, its heritage, workforce, and supplier base are respected and that it continues to contribute to the growth of our Country.

- TValue did not have access to any non-public information, therefore our plan is exclusively based on an outside-in deep analysis of market dynamics, public data and an extensive due diligence effort supported by consultants, financial, accounting and legal advisors across TIM's numerous businesses.

- This work makes us strongly believe in our assumptions and analysis and leads us to conclude that our plan, coupled with TIM's existing strengths and opportunities, can boost shareholder value to better levels when compared to the one presented on 7 March by the company.

- Leadership is key in delivering such a plan. We have a list of candidates to join the board with international and sector expertise, capable of supporting and helping the future management team to execute the plan while fostering a better and more collaborative governance within TIM’s Board of Directors.