Objective: To prevent a significant loss that will undermine the financial system, crystallize a loss (gain) for the hedge funds (redditors) short (long) GME stocks without resorting to new and extraordinary measures.

SOLUTION: Issue a convertible/hybrid instrument to counterbalance the sky high (~700%) demand for call-options on GME shares.

What we know to begin with:

- In its simplest form, Modigliani-Miller (M&M) theory says that the value of a firm is not affected by how it is financed – whether by debt or equity. Taxation, and market inefficiencies are primary reasons this would not be the case. This forms the foundation of modern financial economic theory.

- Robert Merton extended on M&M theorem (also from the University of Chicago) to develop the Merton-model (or firm value model), or firm value model, which states that the equity value of a firm is the residual of Assets minus Liabilities. Merton represented the value of a companies equity (share price) as that of an option on the Asset Price of a firm; struck at the value of the liabilities. The Merton-model links a firm's share price, volatility, and balance sheet to estimate the likelihood of debt default – a novel approach to calculate the credit risk of a company (see Moody's KMV model). The strategy of trading the dislocations in relative values of credit (bond) instruments versus equity, and equity derivatives, is commonly known as Capital Structure Arbitrage.

- Putting together the two Nobel-Prize winning theorems above, it is reasonable to assume a company's decision to raise capital via debt or equity is motivated by whichever is the cheapest source of funding.

- Company's management have a fiduciary duty to maximize shareholder value, which over the long term is reflected in the share price.

- A company has a social purpose in creating and maintaining jobs within the community, and provide a decent standard of living for its employees.

- A rights issue/offer is when a company asks the existing shareholders to put more equity in the company to safeguard the value of shareholders, or to pursue new business opportunities. A rights offering must be in the shareholders best interest according to the regulators.

- A regulator's (SEC) role is to maintain confidence and integrity in financial markets, primarily to protect investors.

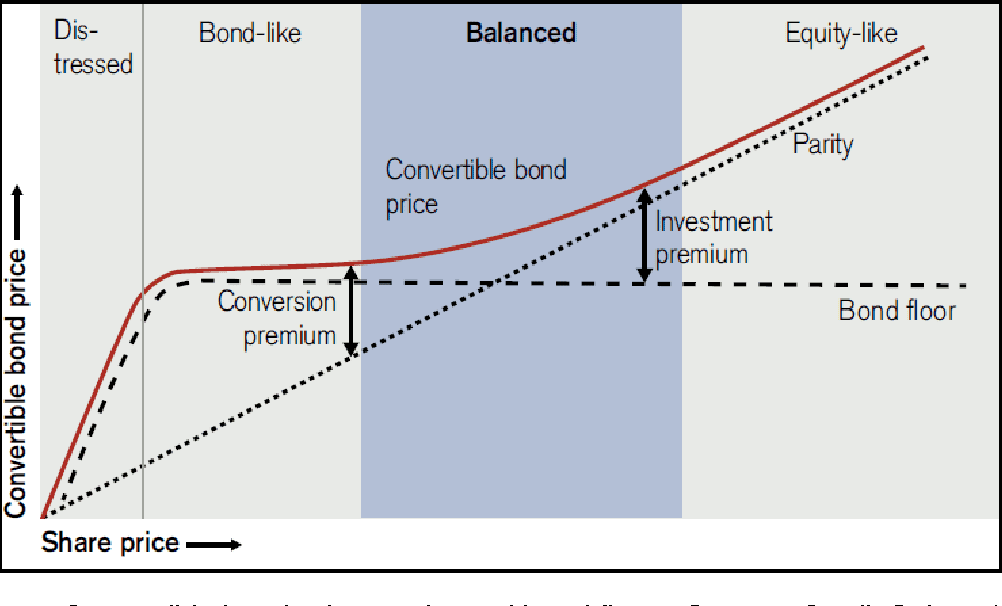

The figure above illustrates the value of a company issued convertible bond issued as a function of the stock price. Considering all the above points, we see a junior hybrid instrument issued by GameStop as the most amenable solution to ending the current stalemate with retail community.

A convertible/hybrid placement to the hedge funds short would:

- Allow the proceeds to be used to pay off the existing expensive debt through a bond at a significant premium to current levels.

- Provide a natural counterbalance (sell) to the sky high implied volatility levels of the stock. Options are for hedging, else speculation. i.e. Options traders are not investors.

- Enable the company to monetize the current market gains, which in turn benefits the shareholders.

- Cap the maximum potential losses at the financial institutions at a level comparable to the face value of the convertible/hybrid instruments. Thus, removing market uncertainty.

- Provide a private market solution which allows the hedge funds take a loss whilst not burning the retail investors.

Naturally, standard advisory and issuance fees shall apply on any hybrid instruments, and a couple of GameStop shorts will be happy buyers to cover their naked shorts.