Both houses of the National Assembly continue to discuss the amended 2020 budget this week and are likely to pass it eventually with few alterations. Yet more than ever, the budget will remain a mere statement of intent, with available pointers suggesting budget implementation will lag even the revised revenue and expenditure targets for 2020. Meanwhile, new central bank data suggests the Covid-19 stimulus package announced in March has been off to a slow start, which could deepen the economic contraction expected to kick in this quarter. Even more worryingly, lawmakers’ eventual approval of a USD 22.7bn medium-term external borrowing plan this week suggests Nigeria will dramatically increase its debt load way beyond the immediate fiscal crisis.

Uncertainty concerning the fiscal and economic impact of Covid-19 and how to respond to it appears to have resulted in several rounds of internal revision before the government eventually sent the amended budget bill to Parliament last week. In March, Minister of Finance Zainab Ahmed still proffered to reduce the budget by NGN 1.5trn (USD 3.9bn, about 15%), yet cuts currently proposed are negligible. The amended budget envisages spending amounting to NGN 10.51trn (USD 27.2bn at the NAFEX rate), which is only marginally below the NGN 10.59trn (USD 27.4bn) budget passed in December.

While this includes new, mostly healthcare-related items in response to Covid-19, reshuffling budget lines in favor of growth-inducing expenditure appears to have been limited. Besides, critical healthcare and educational spending that appears not directly Covid-19 related has been slashed. As such, an opportunity has been missed to sustainably recalibrate spending priorities, arguably not least due to the anticipated opposition from lawmakers insisting on funding for so-called constituency projects and other self-serving expenditure.

Budget vs reality

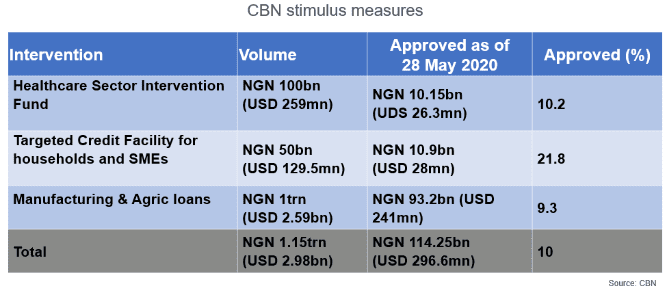

Meanwhile, new data on budget implementation in Q1-2020 suggest that revenue collection was 52% below target while expenditure continued almost as planned. It should be noted that the impact of the Coronavirus disease and the oil price slump only started to kick in towards the end of the quarter, i.e. Q2 will likely look even more dramatic in terms of missed revenue targets. This could be reinforced if the Central Bank of Nigeria (CBN) proves unable to speed up the disbursement of stimulus measures announced in mid-March. On aggregate, merely 10% of applications have been approved as of end-May.

In the lead-up to the plea for help from the IMF, the government also began to account for previously hidden debt owed to the CBN. Accordingly, debt servicing costs increased by 30% above budget plans and swallowed an eye-watering 99.2% of actual revenue in Q1. On the plus side, the data now made available give arguably the most credible account of the federal revenue situation to date.

More debt to the rescue

While the Senate unsurprisingly approved a request for USD 5.5bn in borrowing from bi- and multilateral creditors to plug the most glaring holes in the 2020 budget (which includes USD 3.4bn already granted by the IMF), the House of Representatives also approved a two-year borrowing request over USD $22.7bn (equal to 81% of this year’s budget) on concessional terms, which the Senate had greenlighted already in March. The plan, which had been rejected when first introduced by President Muhammadu Buhari’s government in 2016, would almost double Nigeria’s foreign currency debt stock over the next couple of years.