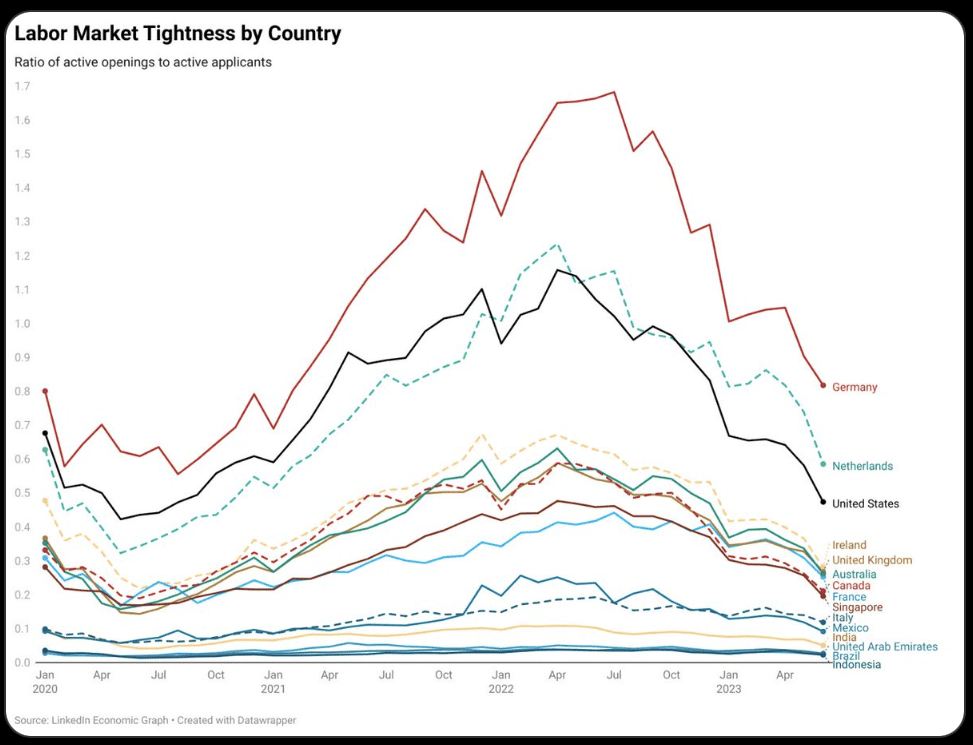

China stimulus | Rising SST | LinkedIn jobs | AI supremacy

Hindsight analysts once again prove as useful as Anne Frank’s drum kit. This time with a less silly investment thesis. LinkedIn labor market data. China stimulus. Econ 101 exam. Trader’s classification revisited.

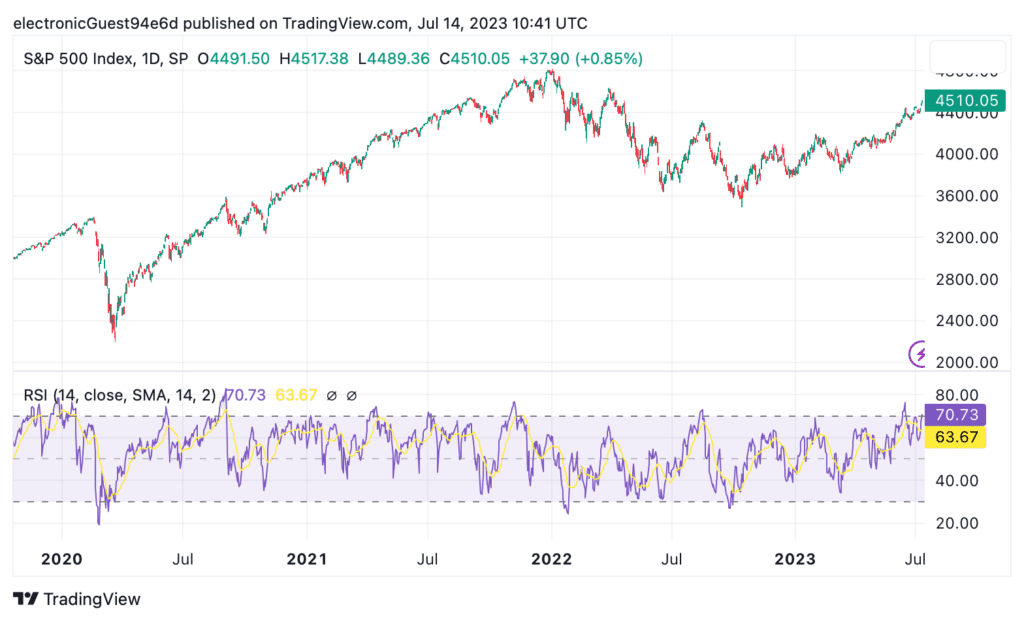

US equities | Who called it right (so far) this year

How would you do in an Econ 101 exam today? Brett Nelson and team at GSWM made the most accurate forecasts for 2023.

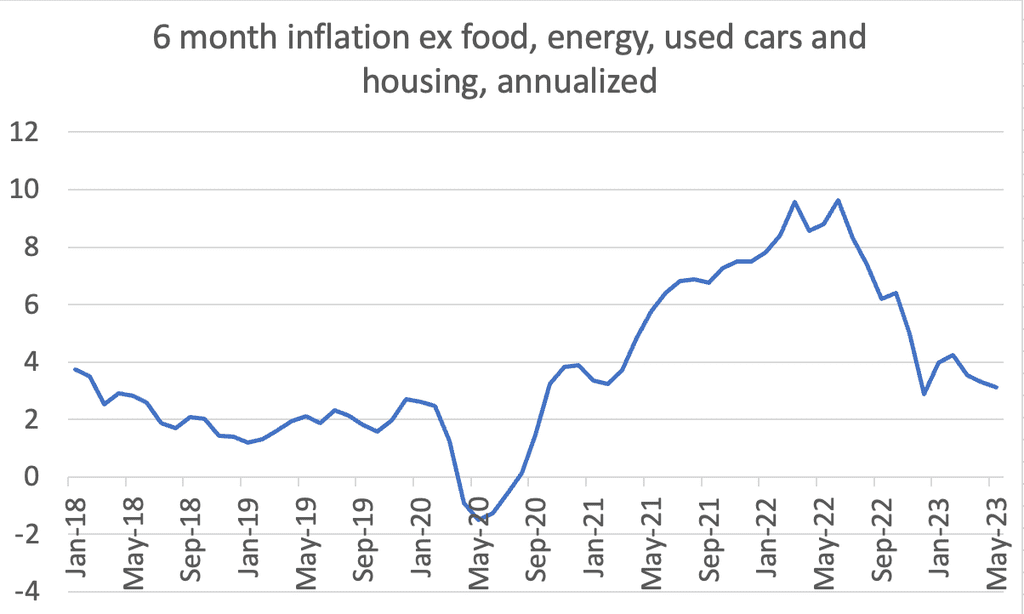

Inflation | Settling the transitory vs. non-transitory debate

No degree in Economics is required to know inflation tends to mean-revert

Market outlook | Superforecasters vs. Domain Experts

A near miss avoided again. Anticipating the next excuse by trapped shorts

US CPI | Team Harvard & Goldman win again

Jason Furman of Harvard notes erroneous Cleveland Fed nowcasting we previously mentioned.

US CPI | 4 scenarios & probability estimates

We consider 4 possible outcomes for the June (2023) CPI number, together with our estimated probabilities and expected market impact. Downside inflation surprised more likely.

US recession | Inflation | Krugman does it again

Once again Paul Krugman uses alternative semi-annual inflation measures to argue his case.

ECB | Constâncio | MS Wilson | BoE

Wall Street perma-bear Mike Wilson continues to perpetuate a false narrative. Things on our radar screens

De-dollarization | Threads vs Twitter | Inflation-yields

Our quick examination of Meta’s new Threads social platform against Twitter. Paul Krugman on de-dollarization.

US economy | How did Volcker kill inflation?

Alan Blinder asked Paul Volcker how monetary policy broke back of the 1970/80s US inflation surge. Is more QT appropriate if inflation doesn’t come down?