Reuven Glick, Noah Kouchekinia, Sylvain Leduc, and Zheng Liu

Household surveys indicate that consumers expect higher inflation this year than in recent years, as the U.S. economy rebounds from the deep recession. This has coincided with a surge in commodity prices, as strong demand for goods like gas, food, and construction materials is catching producers with low supplies. Evidence suggests that households respond to commodity price increases by raising their expectations of future inflation. However, since surges in commodity prices are transitory, their effects on inflation expectations—particularly long-term expectations—are modest and short-lived.

Commodity prices have surged since the U.S. economy began recovering from the recession induced by the COVID-19 pandemic last year. For example, since the lowest point of the recession in April 2020, corn prices have doubled, crude oil prices have roughly tripled, and lumber prices have risen nearly fivefold. Some commodity suppliers who made large production cuts during the pandemic were caught off guard by the strength of the recovery, particularly in sectors that proved resilient to the pandemic, such as residential real estate. In several areas, the dearth of materials is translating into substantial production bottlenecks. These supply chain bottlenecks, combined with the rebound in global demand, have resulted in higher commodity prices. The Standard & Poor’s Goldman Sachs Commodity Index (S&P GSCI), a broad measure of commodity prices, has increased more than 60% relative to its trough in April 2020.

For consumers and businesses, the surge in commodity prices is translating into higher retail prices for food in grocery stores, fuel at gas stations, and construction materials in home supply centers. When people experience large price increases for these prominent components of their consumption baskets, they may start to expect higher inflation in the future. Indeed, household inflation expectations have jumped significantly in recent months.

This Economic Letter examines the sensitivity of household inflation expectations to movements in commodity prices. It shows that commodity price inflation has a statistically significant effect on household inflation expectations: as prices rise, so do expectations. However, this sensitivity of inflation expectations to commodity prices has declined steadily since the late 1980s. Our analysis also shows that households view this impact as short-lived: long-term household inflation expectations are much less sensitive to commodity price movements than short-term expectations. This partly reflects that commodity price surges are typically followed by reversals after suppliers ramp up production to meet demand. Therefore, the increases in inflation expectations from commodity price rises tend to be transitory. This was the case, for instance, during the recovery from the Great Recession, when both commodity prices and household inflation expectations jumped and subsequently reversed.

Changes in commodity prices and inflation expectations

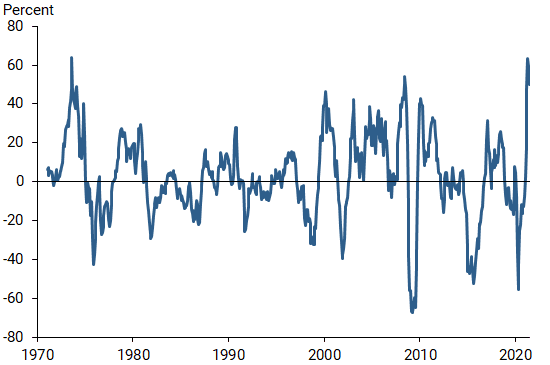

Commodity prices are highly volatile, and large price spikes are very common (see Figure 1). For example, in the early 1970s, the S&P GSCI surged over 60% as a result of the oil crisis. We are currently experiencing a similar surge, with the S&P GSCI increasing over 60% through April 2021 compared with a year earlier.

Figure 1

Commodity price inflation

Note: Measured as year-over-year log difference in S&P GSCI.

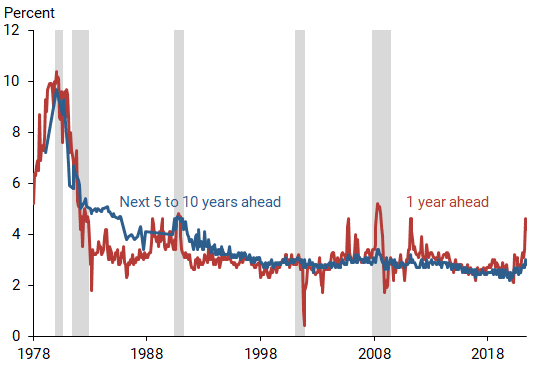

During the same period, household inflation expectations measured by the University of Michigan Surveys of Consumers also jumped, as shown in Figure 2. We focus on household inflation expectations because they are useful in accounting for inflation movements in standard Phillips curve relationships that relate inflation to inflation expectations and measures of economic activity (Coibion, Gorodnichenko, and Kamdar 2018). Moreover, recent studies have shown that household inflation expectations respond more to price changes of frequently bought goods, such as groceries, which are sensitive to commodity price movements (D’Acunto et al. 2021).

Figure 2

Movements in household inflation expectations

Figure 2 shows that households expect substantially higher inflation over the next year. The median one-year-ahead expected inflation rate surged from 2.1% in April 2020 to 4.6% in May 2021, before declining modestly in June. Long-term household inflation expectations—the inflation rate expected over the next 5 to 10 years—also increased, although by a much smaller magnitude. The median long-term expected inflation rate rose from 2.5% in April 2020 to 3% in May this year, before easing off a bit in June.

The large increases in commodity prices and expected inflation during the current economic recovery are not unusual. A similar situation occurred in the early stages of the recovery from the Great Recession when commodity prices rose strongly. One-year-ahead inflation expectations reached 4.6% in March 2011, an increase of more than 2 percentage points over six months, while long-term inflation expectations rose 0.5 percentage point to 3.2% over the same period. The Federal Reserve considered the changes to be temporary and did not respond to these movements. However, some central banks reacted to the commodity price increases by preemptively hiking interest rates. Most notably, the European Central Bank (ECB) tightened monetary policy because of concerns that commodity price inflation would have “second-round effects” by raising inflation expectations, which in turn would push up actual inflation. As commodity price inflation eased in late 2011, the ECB quickly reversed course.

Measuring the sensitivity of inflation expectations to commodity prices

To assess the sensitivity of inflation expectations to commodity prices, we examine statistical relationships between measures of household inflation expectations and commodity price inflation using monthly U.S. data. These relationships assume that households react to past commodity price inflation measured by the percent change in the S&P GSCI over the previous 12 months. To account for slow-moving inflation expectations, we allow current expectations to depend on expectations in the previous month. We also include the previous month’s unemployment rate to account for the impact of economic activity on inflation expectations. Similarly, we include the lagged 12-month change in the core consumer price index (CPI), which excludes the volatile food and energy prices from the headline CPI, to capture the impact of past movements in core inflation on household forecasts of future inflation.

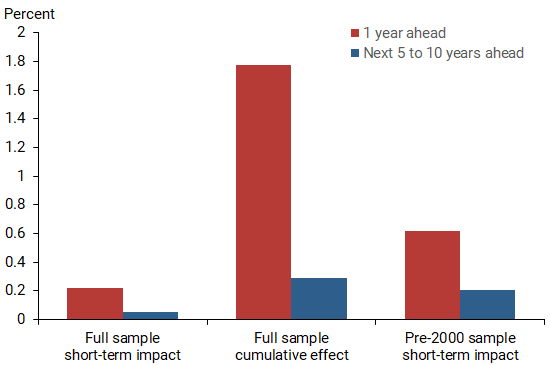

Our statistical analysis shows that commodity price inflation has a small positive effect on both short-term and long-term inflation expectations. As shown in the first set of columns in Figure 3, the 63% surge in commodity prices in the 12 months leading up to April 2021 is associated with a modest 0.25 percentage point increase in one-year-ahead inflation expectations, which is about one-tenth of the actual run-up in short-term inflation expectations. The commodity price increase had an even smaller impact on long-term inflation expectations, raising them by only 0.05 percentage point. The lower sensitivity of long-term expectations partly reflects the transitory nature of commodity price movements: surges are typically followed by reversals. Overall, this evidence suggests that commodity price inflation accounts for a small fraction of the recent increases in short-term and long-term household inflation expectations.

Figure 3

Potential effects of commodity prices on expected inflation

Note: Recent commodity price increase refers to change from April 2020

through April 2021.

However, the direct effect of commodity price movements on expected inflation may not capture the full effect over time because our estimates indicate that underlying inflation expectations are highly persistent. As a result, an increase in inflation expectations today tends to lead to higher expectations in the future.

Taking into account this persistence and assuming that commodity prices stay at their current levels, we estimate the “cumulative” effect of the recent commodity price increase on expected inflation. The second set of columns in Figure 3 shows that this cumulative effect is much larger, particularly for short-term inflation expectations, with one-year-ahead inflation expectations rising nearly 2 percentage points. However, because commodity prices are highly volatile, with large price increases ultimately followed by large price declines, these cumulative effects are likely to be upper-bound estimates.

Declining sensitivity

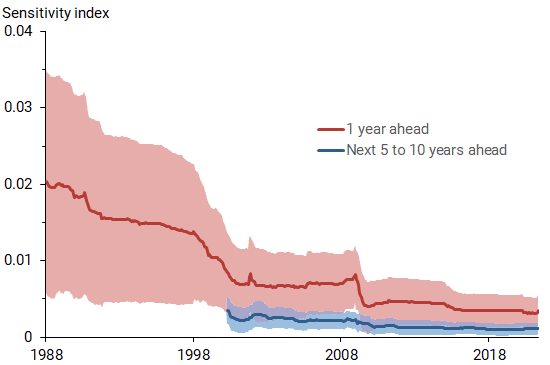

The surge in commodity prices and the recent rise in inflation have led to some concerns about repeating the runaway inflation experience of the 1970s and 1980s. Our analysis suggests that the sensitivity of inflation expectations to commodity price inflation was particularly high back then, but it has declined steadily over time.

Figure 4 displays how much the sensitivity of short- and long-term inflation expectations has changed using the available data at each point in time, beginning with a minimum sample of 10 years. For instance, the first point on the red line shows the sensitivity of short-term expectations in January 1988, using data over the 10-year period from January 1978, when the data on one-year-ahead inflation expectations became available, to December 1987. The second point shows the estimate using the sample from January 1978 to January 1988, and so on, with the last point showing the estimated sensitivity using the full sample through the latest data available in May 2021. Similarly, the blue line reports the changing sensitivity of long-term inflation expectations. Since continuous data for long-term inflation expectations start in April 1990, our estimates of the long-term sensitivity begin in April 2001. The shaded areas around each line indicate the accuracy within a 68% range of our estimates.

Figure 4

Declining sensitivity of expected inflation to commodities

Note: Data account for lagged unemployment, lagged actual core CPI, and lagged CPI expectations.

We find that the impact of increasing commodity prices on household one-year-ahead inflation expectations in the 1980s was nearly six times as large as it is now. In the early 2000s, the sensitivity of inflation expectations was still more than twice as high as it is today. This means that, if households today were to perceive the current environment as similar to that in the 1980s and 1990s, when inflation expectations were more sensitive to commodity price changes, the current commodity price inflation would lead to much larger increases in inflation expectations than what we estimate using more recent data. In particular, as shown in the third set of columns in Figure 3, the surge in commodity prices since a year ago would have pushed up one-year-ahead inflation expectations by slightly more than 1 percentage point in this case, although the effect on long-term inflation expectations would still be relatively modest.

The lower sensitivity of expectations to commodity prices in recent years can largely be attributed to two factors. First, the structure of the economy has changed. Household spending has shifted from goods to services, which require less commodities to produce, and the commodity content of many goods has also declined. Thus, commodity price inflation has smaller effects on overall inflation and inflation expectations than in the past. Second, the conduct of monetary policy has changed significantly since the 1970s and 1980s. The Federal Reserve’s increased focus on price stability and its success in keeping inflation low have improved the credibility of its policies. As a result, inflation expectations have declined steadily over time and remain well anchored at a low level (see Figure 2). Thus, transitory movements in commodity prices—even large movements like those observed over the past year—are unlikely to move inflation expectations, particularly over the longer term.

Conclusion

Commodity prices have surged since the pandemic trough last year, as the nascent economic recovery turned out to be stronger than anticipated. We present evidence that households raise their inflation expectations following commodity price inflation. However, the sensitivity of inflation expectations to commodity price changes has declined steadily over the past 40 years. Because surges in commodity prices are typically short lived and ultimately reversed, their impact on household inflation expectations tend to be transitory, as was the case during the recovery from the Great Recession.

Reuven Glick is a group vice president in the Economic Research Department of the Federal Reserve Bank of San Francisco.

Noah Kouchekinia is a research associate in the Economic Research Department of the Federal Reserve Bank of San Francisco.

Sylvain Leduc is director of the Economic Research Department of the Federal Reserve Bank of San Francisco.

Zheng Liu is a vice president and director of the Center for Pacific Basin Studies in the Economic Research Department of the Federal Reserve Bank of San Francisco.

References

Coibion, Olivier, Yuriy Gorodnichenko, and Rupal Kamdar. 2018. “The Formation of Expectations, Inflation, and the Phillips Curve.” Journal of Economic Literature 56(4), pp. 1,447–1,491.

D’Acunto, Francesco, Malmendier, Ulrike, Juan Ospina, and Michael Weber. 2021. “Exposure to Grocery Prices and Inflation Expectations.” Journal of Political Economy 129(5), pp. 1,615–1,639.