Robert E. Hall and Marianna Kudlyak

Unemployment fell at a slow and steady rate in the 10 cyclical recoveries from 1949 through 2019. These historical patterns also apply to the recovery from the pandemic recession after accounting for the unprecedented burst of temporary layoffs early in the pandemic followed by their rapid reversal from April to November 2020. Unemployment for other reasons—which has been most important in other recent recoveries—did not start declining until November 2020. Since then, unemployment for other reasons has declined at a faster pace than its historical average.

The global pandemic caused an unprecedented surge in the U.S. unemployment rate, followed by a rapid decline. From February to April of 2020, the unemployment rate spiked from 3.5% to 14.8%. Starting in May, unemployment dropped 8 percentage points over the first seven months of the recovery, falling to 6.7% by November 2020. Since then, the pace of the decline has slowed substantially, with a further drop of about 2 percentage points to 4.6% as of October 2021.

In this Letter, we consider how unemployment in the pandemic has been different from recoveries over the past 70 years and how it has been the same. The initial unemployment recovery was much faster during the pandemic recovery than in the past. For example, following the 2007–09 recession, it took 10 years for total unemployment to decline by 6.5 percentage points. The rapid recovery immediately following the spike in April 2020 led some people to predict that unemployment would quickly return to its pre-pandemic level, which it has not done.

We show that, after we account for the unusual surge in temporary layoffs, the unemployment pattern in the current recovery is actually similar to the past. Workers on temporary layoff depart from unemployment quickly, mainly because they are recalled to their existing jobs, but also because some take new jobs or leave the labor force. We refer to those counted as unemployed who are not on temporary layoff as the jobless unemployed. Their unemployment is much more persistent than those on temporary layoff. Historically, a large fraction of the people who were counted as unemployed were jobless—they were not on layoff from a continuing job. In the pandemic recession, the jobless unemployment rate reached its 4.9% peak in November 2020. We find that its recovery has been much slower than for temporary layoffs, though somewhat faster than in previous recoveries.

Recoveries of U.S. unemployment over 1949–2019

From examining the historical patterns of unemployment, we find that unemployment recoveries from 1949 through 2019 were inexorable (Hall and Kudlyak 2021a). Unemployment rose rapidly in 10 economic crises. The crises that propelled unemployment sharply upward had widely different causes. For example, the 1981 recession resulted from a sharp monetary contraction, while the 2007 recession got its severity from the financial crisis.

Despite different reasons for rising unemployment, following each crisis the unemployment rate glided downward on a predictable recovery path. The glide continued until unemployment reached about 3.5% or until another crisis interrupted the glide. Despite considerable variation in monetary and fiscal policy, and in productivity and labor force growth, the rate of unemployment decline was remarkably similar across these episodes. The economy seemed to have an irresistible force restoring full employment at a pace that remained relatively constant throughout the past 70 years.

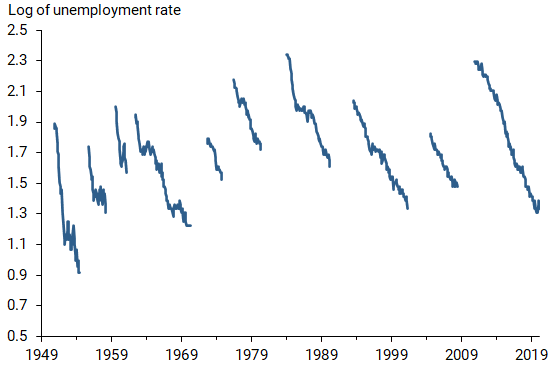

Figure 1 displays the unemployment rate expressed in natural log values during the 10 completed recoveries since 1949; to highlight the recovery patterns, we exclude the periods of sharply rising unemployment during recessions. The figure reveals a key historical fact about recoveries: the log of the unemployment rate tends to fall in a virtually straight line, indicating a relatively steady proportional decline in the actual rate over time.

Figure 1

Paths of log unemployment during recoveries

Source: Hall and Kudlyak (2021c).

In particular, we estimate that unemployment during a recovery drops approximately 10% per year. For example, in a recovery starting from a 9% unemployment rate, the unemployment rate would drop 0.9 percentage point to 8.1% after one year, then 0.81 percentage point to 7.3% after two years, and so on.

Reasons for historically slow unemployment recoveries

In Hall and Kudlyak (2021c), we examined why unemployment tends to recover so consistently slowly in economic recoveries. We find that a typical crisis breaks employment relationships, and the process of creating new stable relationships is time-consuming. Workers who lost jobs often cycle through short-term jobs with spells of unemployment and being out of the labor force before finding stable employment (Hall and Kudlyak 2019). We find that high unemployment further slows down the job search and matching process. For example, employers face additional costs in selecting the most suitable prospective workers from among the many applicants; this can make it more difficult for other job seekers to find the right jobs, in addition to those who lost jobs in the crisis.

Two kinds of unemployment during the pandemic recession

Hall and Kudlyak (2021b) distinguish between temporary-layoff unemployment and unemployment for other reasons, which we refer to as jobless unemployment. The distinction is important because temporary-layoff unemployment typically returns to normal much faster than does jobless unemployment. The unemployed on temporary layoff often do not go through the time-consuming process of finding stable long-term employment that explains much of the consistency and slow pace of past recoveries. They wait out periods of nonwork with the understanding that their jobs still exist and that they have a good chance of being recalled.

Historically, the vast majority of people who were counted as unemployed were jobless—meaning they were not on layoff from a continuing job. At the start of the pandemic recession, however, an unprecedented number and fraction of the unemployed were on temporary layoff and had a good chance of being recalled to their prior jobs (see, for example, Wolcott et al. 2020).

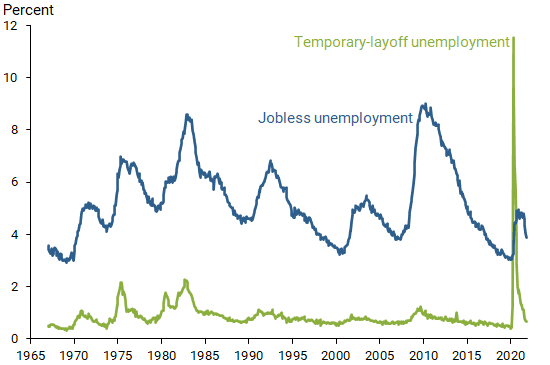

Figure 2 shows the temporary-layoff and jobless unemployment rates, from January 1965 to the latest data available, October 2021. We classify unemployed workers into these two groups based on their reported reason for unemployment and then divide each group by the size of the total labor force.

Figure 2

Temporary-layoff and jobless unemployment, 1967–present

Note: Temporary layoff reflects unemployment of people on layoff with expectation of recall. Jobless reflects unemployment for other reasons. The two add up to the total unemployment rate. The series are expressed as percentages of the labor force and are seasonally adjusted. Data extend through October 2021.

March 2020 was the first month that the pandemic noticeably influenced the labor market. Before then, historical data show that temporary-layoff unemployment has been small in relation to jobless unemployment. When the labor market was strong and unemployment was low, the temporary-layoff portion was under 1% of the labor force, while jobless unemployment only dropped below 4% in the strongest years. In recessions, jobless unemployment has sometimes risen to close to 9% of the labor force. In the recessions starting in 1974 and 1981, temporary-layoff unemployment rose to 2%, but it hardly rose at all in the later recessions of 1990 and 2001.

Unemployment recovery from the pandemic recession

Breaking unemployment into these two categories sheds light on the unique recovery patterns from the pandemic recession. From April to November 2020, total unemployment declined 8.1 percentage points, from 14.8% to 6.7%, a much faster drop than in previous recoveries. The temporary-layoff unemployment rate declined 10.8 percentage points, from 11.5% to 1.7%. During that period, the jobless unemployment rate increased, reaching its pandemic peak of 4.9%.

Since November 2020 the recovery of the total unemployment rate has slowed. Between November 2020 and October 2021, the total rate fell 2.1 percentage points. About half of this drop is in temporary-layoff unemployment, and the other half is recovery of jobless unemployment. The decline in the total unemployment rate has slowed because temporary-layoff unemployment had mostly dissipated by the end of 2020; the remaining unemployment was jobless unemployment, which typically declines at a much lower rate.

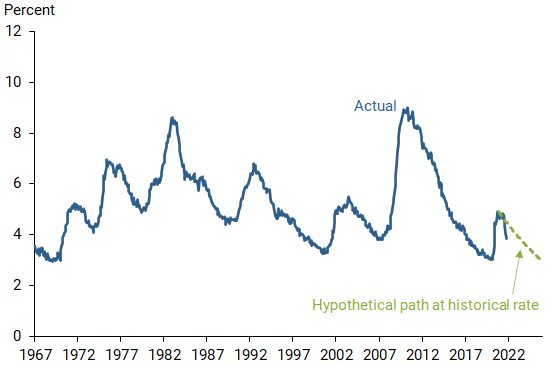

Figure 3 shows the path of actual jobless unemployment (solid line) and the hypothetical path starting from November 2020 if the recovery had been on its historical path (dashed green line). The deviation of those two lines during the period from the recent peak in November 2020 through October 2021 indicates that the recovery of jobless unemployment has been more than double its historical rate.

Figure 3

Jobless unemployment: Actual and hypothetical paths

Conclusions

In the 10 unemployment recoveries over 1949–2019, unemployment glided downward. After 1960, the glide was at a constant proportional rate of 10% per year. This historical regularity of unemployment recoveries applies to the recovery from the pandemic recession as well, after accounting for the unprecedented surge and recovery in temporary-layoff unemployment. The reversal of temporary layoffs accounted for the entire decline in total unemployment from April to November 2020, but this dissipated considerably by the end of 2020. During that period the jobless unemployment rate was increasing. In November 2020, jobless unemployment reached its pandemic peak and subsequently began to recover. Since then, the recovery of jobless unemployment has been speedier than its historical pace during the previous 10 recoveries.

Robert E. Hall is Robert and Carole McNeil Joint Hoover Senior Fellow and Professor of Economics Stanford University.

Marianna Kudlyak is a research advisor in the Economic Research Department of the Federal Reserve Bank of San Francisco.

References

Hall, Robert E., and Marianna Kudlyak. 2019. “Job-Finding and Job-Losing: A Comprehensive Model of Heterogeneous Individual Labor-Market Dynamics.” FRB San Francisco Working Paper 2019-05.

Hall, Robert E., and Marianna Kudlyak. 2021a. “The Inexorable Recoveries of US Unemployment.” FRB San Francisco Working Paper 2021-20.

Hall, Robert E., and Marianna Kudlyak. 2021b. “The Unemployed with Jobs and without Jobs.” FRB San Francisco Working Paper 2021-17.

Hall, Robert E., and Marianna Kudlyak. 2021c. “Why Has the U.S. Economy Recovered So Consistently from Every Recession in the Past 70 Years?” NBER Macroeconomics Annual 2021, volume 36.

Petrosky-Nadeau, Nicolas, and Robert G. Valletta. 2020. “Unemployment Paths in a Pandemic Economy.” FRB San Francisco Working Paper 2020-18.

Wolcott, Erin, Mitchell G. Ochse, Marianna Kudlyak, Noah A. Kouchekinia. 2020. “Temporary Layoffs and Unemployment in the Pandemic.” FRBSF Economic Letter 2020-34, (November 16).