Stephie Fried, Kevin Novan, and William B. Peterman

Uncertainty about U.S. climate policy in the future creates risk that affects the investment decisions businesses make today. If firms expect future policy to raise the cost of carbon emissions, then they could react to this by both shifting investment towards cleaner capital and reducing overall investment. These two responses lead to lower emissions, even if no actual climate policy is in place. Evidence suggests that this risk encourages companies to voluntarily reduce emissions using internal carbon prices and other mechanisms.

While the United States does not currently have federal policies in place that directly impose a cost on carbon emissions, it is widely understood that such policies could be adopted in the future. Legislators have tried several times to enact federal laws to reduce carbon emissions. The 2009 American Clean Energy and Security Act, which passed in the House but not the Senate, would have established a national cap-and-trade program to reduce carbon emissions. In 2015, the Obama Administration announced the Clean Power Plan to regulate carbon emissions from power plants. Most recently, the Biden Administration signaled its interest by rejoining the Paris Climate Agreement.

Many U.S. industries rely on long-lived equipment and structures that run on fossil fuels. Thus, the possibility that future climate policies will impose a cost on carbon emissions creates a risk to business sector profits. For example, if a firm invests in a coal boiler today and the government introduces a tax on carbon emissions in the future, the firm will receive lower returns from the coal boiler. However, firms increasingly have options for newer machinery and production processes that result in lower carbon emissions. Thus, the possibility of future climate policy creates the potential for higher returns on investments that are designed to replace fossil fuels, such as solar panels.

Given the dominant role fossil fuels play in the production of goods and services, the possibility of future climate policy may have far-reaching impacts across the economy, even before such policy is put in place. Fried, Novan and Peterman (2021) explore the economic impact of this climate policy risk and its potential to reduce emissions. To quantify business expectations about future carbon taxes, we study data on “internal carbon fees,” a tool companies use to voluntarily reduce their emissions. Our findings suggest that the risk of the United States adopting a climate policy in the future causes businesses to shift current investment to less carbon-intensive capital and reduce overall investment. This response leads to lower emissions, even though no actual climate policy is in place. For example, we find that a 10% chance of a $45 carbon tax generates approximately one-tenth of the emissions reduction that one would expect from an actual $45 carbon tax.

Investment decisions under climate policy uncertainty

Our model of the U.S. economy assumes that firms can invest in three types of capital equipment and structures: fossil capital, which is specialized to use fossil fuel, such as a coal boiler; clean capital, which is specialized to substitute for fossil capital or fossil fuel, such as a solar panel; and energy-neutral capital, which is not specialized to use or replace fossil fuel, such as a sewing machine. While a sewing machine requires electricity, it does not matter if that electricity is produced from fossil or clean energy, thus making it energy neutral. We assume that businesses must make long-term investment decisions without knowing whether the government will introduce a carbon tax in the future. Instead, they judge the likelihood that the government will introduce a carbon tax or other climate policy and base their combination of fossil, clean, and energy-neutral capital investments on that belief.

To determine what firms believe about the likelihood of a future carbon tax, we use the information revealed by internal carbon prices. An internal carbon price is a tool that firms voluntarily use to reduce their carbon emissions by distorting their investment decisions (Ahluwalia 2017). For example, Microsoft imposes an internal carbon fee of $10 per ton of carbon dioxide (CO2) on the emissions resulting from its energy use. While business surveys suggest that concerns over future climate policy are a primary reason for using internal carbon fees, firms could also be motivated by other factors, such as green branding or corporate social responsibility. To account for these other factors, we conservatively lower the value of the internal fee we use to assess firms’ beliefs of a future carbon tax.

Consistent with estimates of the social cost of carbon from the Environmental Protection Agency (EPA), we first assume that, if adopted, a carbon tax would be set at $45 per ton of CO2. Because climate policies are designed to be permanent, we assume that, once the $45 tax is in place, it stays there forever. From there, we determine the likelihood that firms place on the introduction of a carbon tax. We do so by comparing a firm’s chosen portfolio of fossil and clean capital under a voluntary internal carbon fee and the certainty that the carbon tax will not be adopted in the future against the firm’s chosen capital portfolio under no voluntary internal carbon fee but with the chance that the $45 tax could be implemented next year. We find that the likelihood that equates the firm’s capital portfolio in both cases is a 10% chance that the government will introduce a carbon tax in the next year. This likelihood implies a 50% chance that the government will introduce a carbon tax within the next eight years.

Climate policy risk reduces emissions and output

To determine the effects of climate policy risk in our model, we compare outcomes under three different scenarios: (1) an economy without a carbon tax and without risk of a future carbon tax; (2) an economy without a carbon tax but with a 10% chance that the government will introduce a $45 carbon tax next year, implying that firms anticipate that the government could introduce a carbon tax at some point in the future; and (3) an economy with a $45 carbon tax already in place. We compare these scenarios in terms of four economic outcomes: carbon emissions; the stock of capital equipment and structures, simply termed “capital”; the ratio of clean capital to fossil capital; and the ratio of labor used to run clean capital to labor used to run fossil capital, simply termed “ratio of clean to fossil labor.”

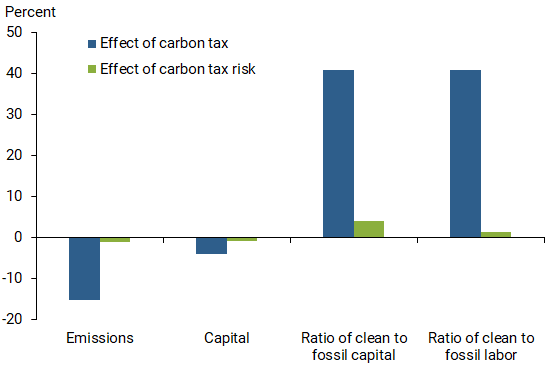

We start by comparing the outcomes from scenario (3), the economy with the tax already in place, to those of scenario (1), the economy with no current tax or risk of a future one. The blue bars in Figure 1 show the percent change resulting from a carbon tax for each of the four outcomes. Not surprisingly, the presence of the carbon tax results in lower carbon emissions and higher ratios of clean production inputs relative to fossil production inputs. Additionally, the carbon tax makes overall investment less profitable because it raises the cost of the energy firms use to produce output. As a result, the carbon tax causes the total capital stock, and hence output and emissions, to fall.

Figure 1

Effects of climate policy risk on economic outcomes

To isolate the effects of climate policy risk, we compare scenario (2), the economy with no tax but with risk of a future tax, to scenario (1), the economy with no tax and no risk of a future one. The green bars show the percent change resulting from the risk of a carbon tax for each of the four outcomes. We find that the possibility of a carbon tax in the future decreases emissions today, even though no actual climate policy is in place. The height of the green bar in the first group is approximately one-tenth the height of the blue bar. This comparison reveals that climate policy risk by itself is responsible for approximately one-tenth of the drop in emissions going from an economy with no risk of a future carbon tax to an economy with a carbon tax in place.

To understand why the risk of a future carbon tax results in lower emissions, recall that the actual carbon tax reduces emissions because total capital falls, implying that firms produce less, and because clean capital and labor rise relative to fossil capital and labor, implying that firms’ remaining production is cleaner. The risk of a future carbon tax reduces emissions through the same two channels. The rise in the expected cost of the fossil energy increases the expected profitability of investing in clean capital relative to fossil capital, shifting the economy toward cleaner production. Additionally, it reduces the expected profitability of overall investment, decreasing total capital and hence causing output and emissions to fall.

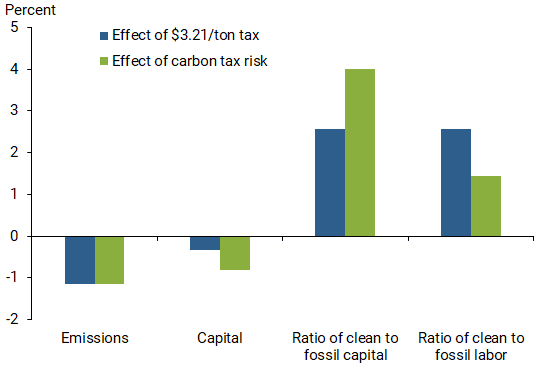

To analyze how the consequences from climate policy risk are different from an actual carbon tax, we calculate an emissions-equivalent tax—that is, a tax that reduces emissions by the same amount as the climate policy risk. The emissions-equivalent tax equals $3.21 per ton of CO2, implying that the 10% chance of a $45 future carbon tax reduces emissions by the same amount as a $3.21 carbon tax imposed now. This emissions-equivalent tax is lower than the expected value of a $45 tax with a 10% probability of being enacted, which would be $4.50, because we assume that firms hire labor after they learn whether the government introduced a carbon tax. Thus, the flexibility in the timing of hiring offsets some of the decrease in emissions implied by firms’ investment response to climate policy risk.

Figure 2 compares the effects of climate policy risk (green bars) and the emissions-equivalent tax (blue bars) on the same four outcomes as in Figure 1. While both the carbon tax and climate policy risk reduce emissions by shifting the economy towards cleaner capital and labor and lowering total capital, they differ in how much they rely on each of these mechanisms. Compared with the emissions-equivalent tax, climate policy risk results in a larger reduction in total capital. Consequently, output is lower under climate policy risk than under the emissions-equivalent tax; this makes climate policy risk a relatively costly way to reduce emissions.

Figure 2

Effect of climate policy risk versus emissions-equivalent tax

The main reason climate policy risk leads to a larger decrease in capital is because the uncertainty distorts the firm’s use of capital inputs relative to labor inputs. Because labor is a more flexible input, firms can adjust labor after they learn whether there will be a carbon tax. As a result, the effect of climate policy risk on clean and fossil labor is different from its effect on clean and fossil capital. This distortion to the relative use of capital and labor further reduces the overall profitability of investment, leading to the larger decrease in total capital. In contrast, under the emissions-equivalent tax, there is no uncertainty and hence no distortion to the relative use of capital and labor.

Conclusion

The possibility that a country will enact climate policy in the future affects firms’ behavior today, reducing both output and emissions. A 10% chance of a $45 carbon tax generates approximately one-tenth of the emissions reduction that one would expect from an actual $45 carbon tax. The odds that governments impose climate-related policies may grow in the future. Such changes would amplify the effects of climate policy risk, making it even more important for businesses and policymakers to account for the economic effects already resulting from this risk.

Stephie Fried is a senior economist in the Economic Research Department of the Federal Reserve Bank of San Francisco.

Kevin Novan is an associate professor at the University of California, Davis.

William Peterman is chief of the Fiscal Analysis Section in Research and Statistics at the Federal Reserve Board of Governors.

References

Ahluwalia, Manjyot Bhan. 2017. The Business of Pricing Carbon: How Companies Are Pricing Carbon to Mitigate Risks and Prepare for a Low-Carbon Future. Arlington, VA: Center for Climate and Energy Solutions.

Fried, Stephie, Kevin Novan, and William Peterman. 2021. “The Macro Effects of Climate Policy Uncertainty.” FRB San Francisco Working Paper 2021-06.