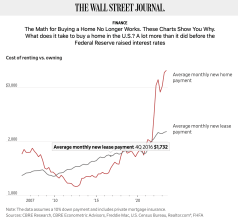

US Housing costs rise again

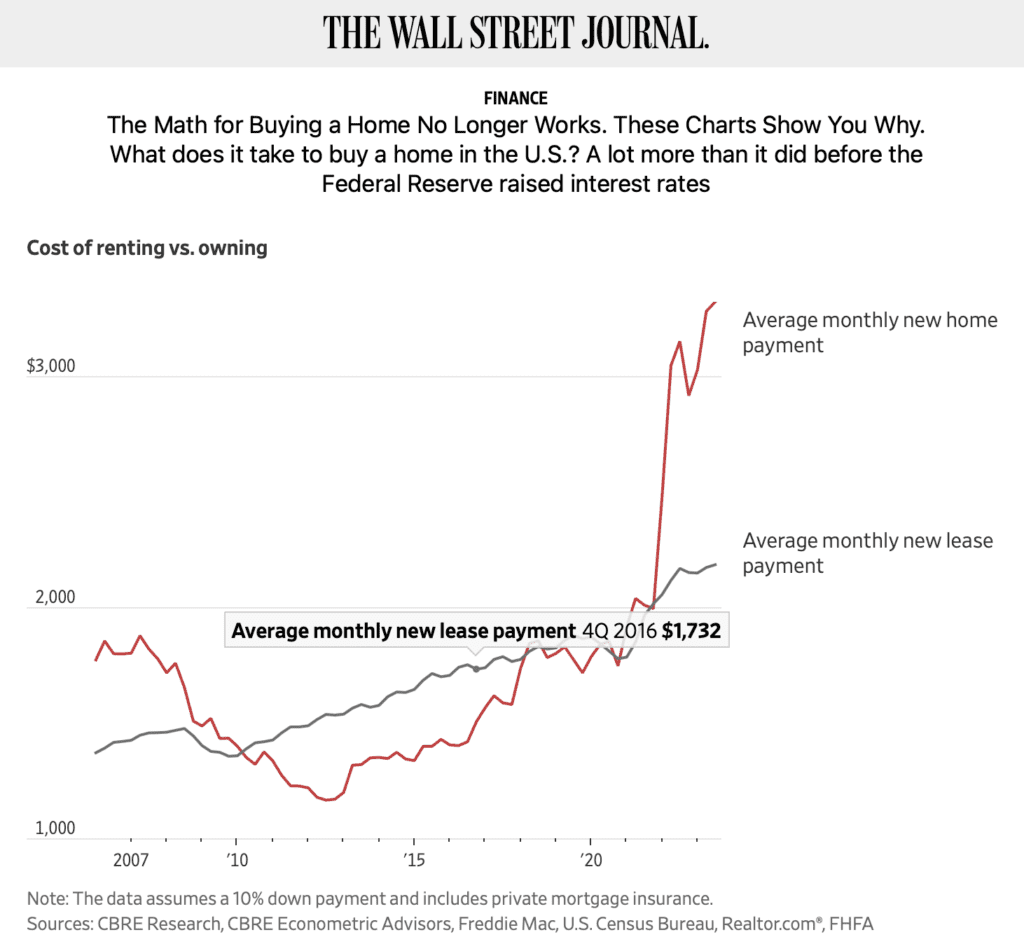

Well, the US CPI came in stronger than consensus, while stocks experienced a slight sell-off, contrary to our expectations. The credit markets showed a relatively firm/muted response. Rent and shelter costs have once again become a focal point. Des...

Speevr Intelligence

The Speevr Intelligence daily updates provide in-depth alternative perspectives on key themes and narratives driving financial markets. Our unique collection brings Speevr's exclusive content together with partners' research and analysis.