“Every cockroach is beautiful in the eyes of its mother”

— Old Italian saying

The same saying applies to research written by analysts.

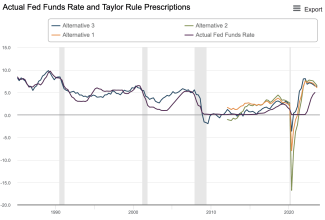

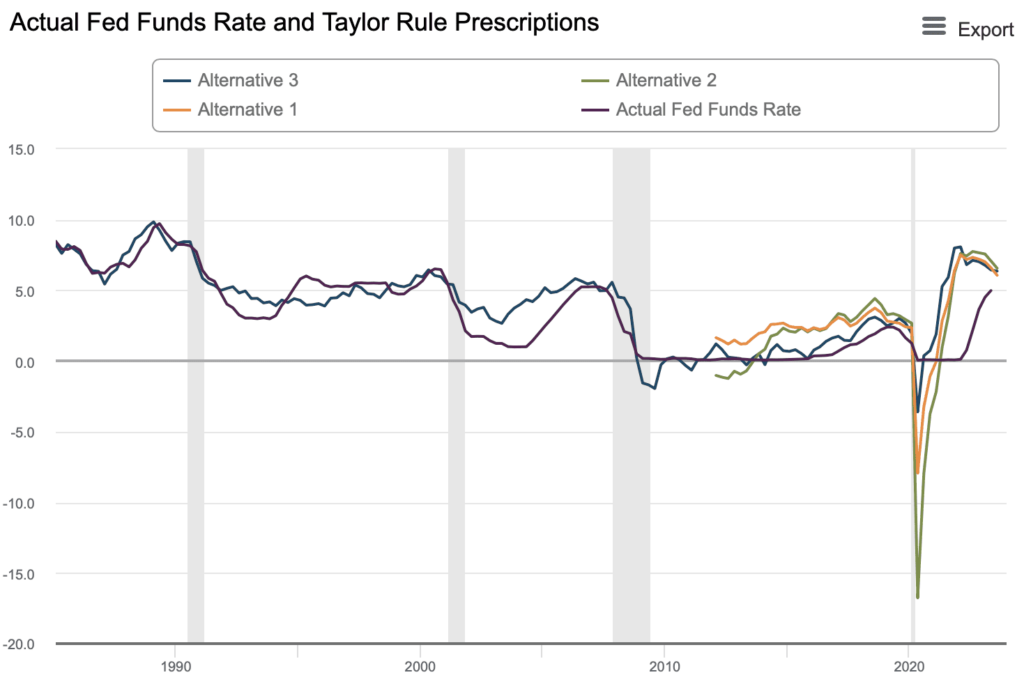

In this update, we present a convergence of positive macroeconomic and political factors that lead us to be more optimistic about risk assets in the medium-to-long term. Our viewpoint contradicts the mainstream Wall Street outlook, which primarily hinges on known unknowns tied to deteriorating fundamentals as part of the regular business cycle. We also cover the pros and cons of the Taylor Rule for setting monetary policy. A brief comment on historical structure of the US Treasury market and Central Bank Digital Currencies (CBDCs). As well as Olivier Blanchard's latest take on the shape of the US labor market Beveridge curve.

Finally, no update is complete without us slamming Mike Wilson of Morgan Stanley for displaying weak leadership by suggesting that his colleagues were partially responsible for his inaccurate market calls during 2023. Despite knowingly going against the house view ...