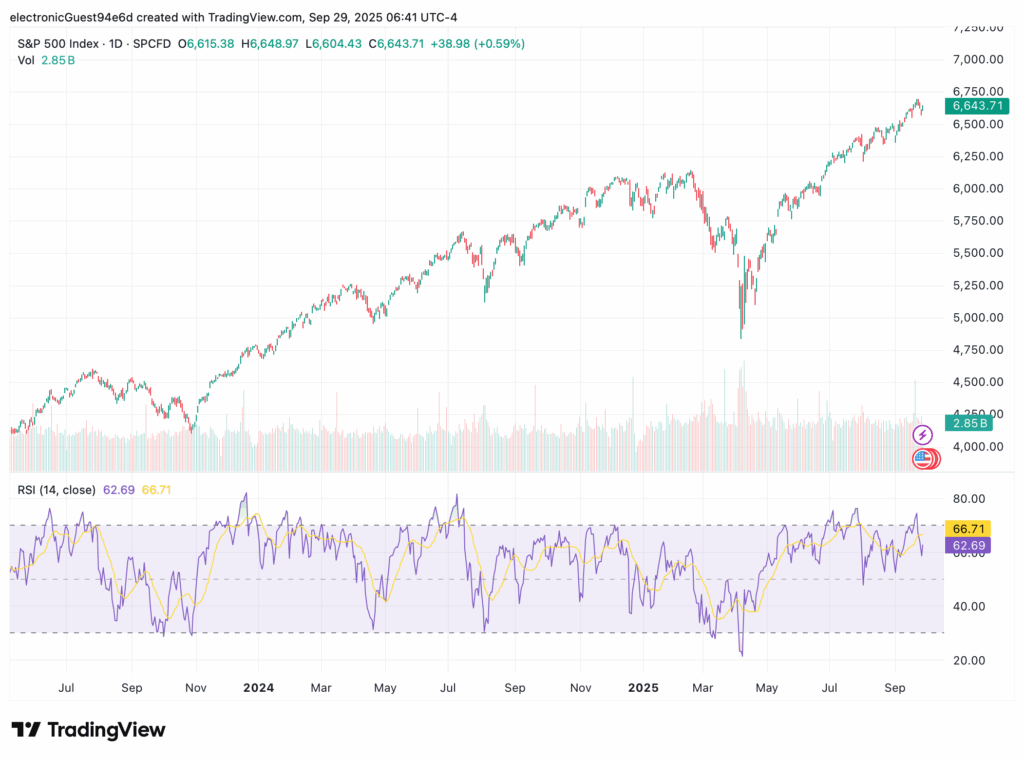

It's amusing how the timid bears always reveal their hands whenever the market wobbles by just 1%. So, did you catch one of the largest market rallies in recent history? “A little bit.” Yeah, yeah, me too. Only my performance doesn't quite reflect it.

I know the BoJ still loves me despite all the years of pain

Every decade, the Bank of Japan (BoJ) hands a big gift to macro investors. Then, they spend the next 9 years giving it all back and then some. The lessons from earlier this year were quickly forgotten. God loves a trier. It's difficult to have an edge on the BoJ stuff if you can't read the Tokyo Times without the help of Google Translate.

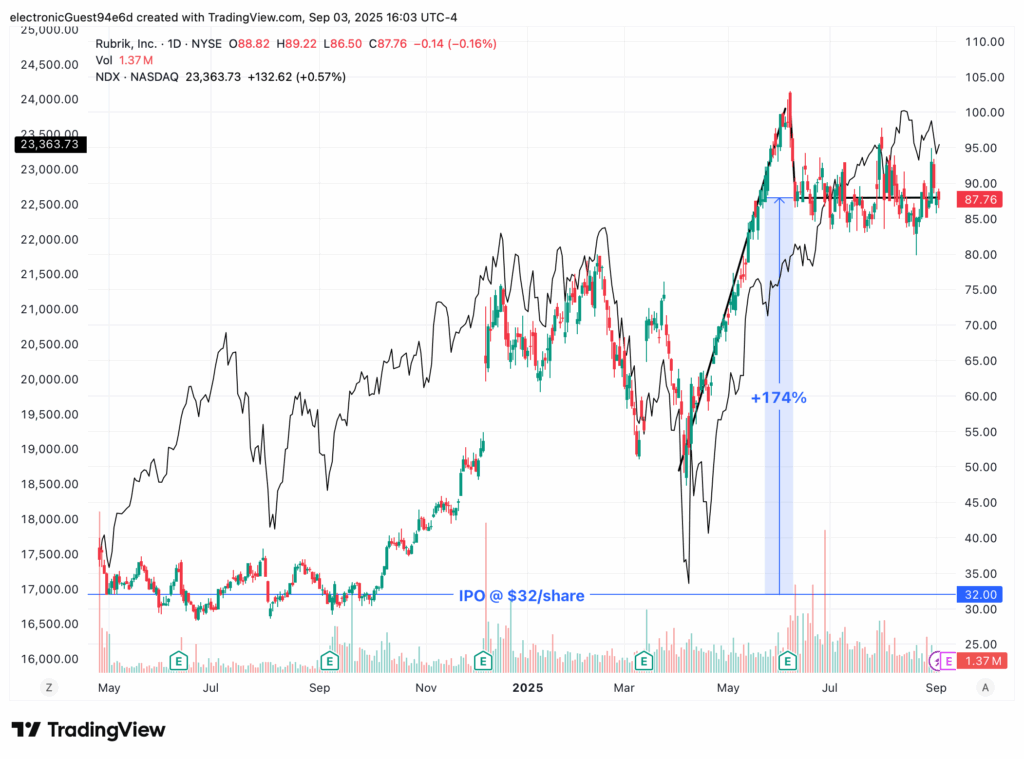

Capex & Big Tech delivering on AI

Currently, we don't have a strong view on US equities at current levels. What seems evident is that Big Tech has delivered on the so-called ‘AI hype bubble' in the most recent quarterly earnings. We suspect the rapid increase in capex expenditure by S&P 500 companies, which some analysts are concerned about, is the result of net transfers between those seeking to build out their AI capabilities to vendors with the technology—inline with our June (2023) update—see JPM on De-dollarization | Is AI a bubble?

However, we haven't investigated to confirm if this is the case. So please don't take our word for it. But that's usually how it works… Everyone is a product or customer of Big Tech in some shape or form because they build incredibly convenient tools for the masses.

US Treasury pain trade ahead

Based on the hostile reaction to our suggestion that rising bond yields and falling inflation are a likely possibility, most market participants are on the wrong side of the position/trade. The ‘pain trade' is probably for bond yields to move higher. Besides market technicals and supply-demand dynamics, we also lack a sound thesis to justify the position. Nonetheless, lower inflation and higher bond yields have been the trend since the debt ceiling resolution was reached. And one that is likely to continue further in the near future. Someone has to finance the ongoing US budget deficit if not central banks.

When classical macroeconomic theories do not work

Time and again, we've shown that market consensus builds around very approximate classical macroeconomic theories, only for reality to be different. If there were a Black-Scholes equivalent for pricing bonds from inflation (or inflation expectations), we would place more weight on the theoretical case for lower yields. As such, the practical framework where transaction prices (not inflation or yields) are the underlying process works much better for those wishing to make money in markets. Even if it's intellectually less satisfying and only works over short time horizons.

Time to share some curated research reports with our members by folks who know what they're talking about.