Ethan Goode, Zheng Liu, and Thuy Lan Nguyen

The United States has implemented large-scale fiscal policy measures to help households and businesses cushion the economic fallout from the COVID-19 pandemic and to strengthen the recovery. The Federal Reserve has also supported the economy by keeping its policy rate at the zero lower bound. Evidence from Japan suggests that, in a sustained zero-bound environment, an unexpected increase in government spending has much larger and more persistent effects on real GDP, and even more so when the economy is in a recession.

The scale and scope of U.S. fiscal policy measures since the onset of COVID-19 are unprecedented in recent history. The $1.9 trillion American Rescue Plan became law on March 11, 2021, injecting a new round of fiscal stimulus to strengthen the economic recovery. This followed the $2.2 trillion Coronavirus Aid, Relief, and Economic Security Act and the $900 billion coronavirus relief and government funding bill in 2020. In addition, the Biden Administration has proposed $1.8 trillion in new spending and tax changes over 10 years and a $2.3 trillion infrastructure plan. At the same time, monetary policy has been highly accommodative, with the Federal Reserve’s policy interest rate remaining at the zero lower bound (ZLB).

In this Letter, we evaluate how the ZLB policy can influence the effectiveness of fiscal policy and how the fiscal stimulus effect varies depending on whether the economy is growing or in a recession. We use quarterly data from Japan for 1980 to 2019, including a 25-year span of zero interest rates beginning in late 1995. During those years under the ZLB, Japan has gone through four boom-bust cycles. This sample allows us to estimate the economic impact of fiscal stimulus during both ZLB and normal periods. It also allows us to study the interactions between the effects of the ZLB and recessions. We find that the stimulus effect of government spending is significantly larger and much more persistent under the ZLB than in the normal period. We also find that, in a sustained ZLB environment, fiscal stimulus is especially effective during recessions.

Fiscal stimulus under the ZLB

The effectiveness of fiscal stimulus is typically measured by a government spending multiplier. This is the percent change in real (inflation-adjusted) GDP resulting from a change in government spending equal to 1% of GDP.

Economic theory suggests that the fiscal multiplier can be large when monetary policy is constrained by the ZLB (see, for example, Christiano, Eichenbaum, and Rebelo 2011). An increase in government spending initially pushes up aggregate demand, boosting inflation and inflation expectations. Since the nominal interest rate stays at zero, the real interest rate—the nominal interest rate minus expected inflation—falls, which stimulates private consumption and investment spending. The increase in private spending raises aggregate demand further, reinforcing the expansionary effects of government spending. In contrast, monetary policy in normal times would react to an increase in inflation expectations by raising the nominal interest rate, and such reactions would mitigate the expansionary effects of government spending, resulting in a smaller fiscal multiplier.

Estimating the fiscal multiplier under the ZLB is challenging because sustained ZLB events in advanced economies have been relatively rare (Ramey and Zubairy 2018). When they do occur, they often coincide with deep recessions, as was the case from December 2008 to December 2015, prompted by the Great Recession of 2007–09.

Confronting challenges with evidence from Japan

To overcome these challenges, we turn to quarterly data from Japan between 1980 and 2019, extending the approach of Miyamoto, Nguyen, and Sergeyev (2018).

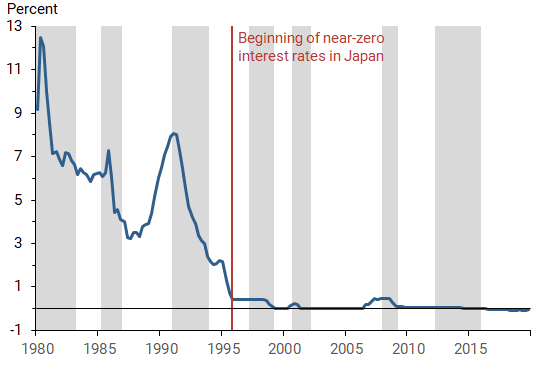

Japan’s short-term nominal interest rate has stayed near zero since the fourth quarter of 1995 (Figure 1), providing 25 years of data on the ZLB period. Thus, the full sample allows us to estimate the government spending multipliers both with and without the ZLB constraint. Furthermore, during this long spell of ZLB, Japan has gone through four boom-bust cycles, with recessions indicated by the shaded bars in the figure. This helps us examine the interactions between the effects of the ZLB and of recessions.

Figure 1

Short-term nominal interest rates in Japan

Note: Rates are measured by the average quarterly overnight bank call rates,

1980–2019. Gray shaded bars indicate recessions; the red line marks the

beginning of the ZLB period in the fourth quarter of 1995.

Source: Bank of Japan.

It is generally difficult to identify whether an unexpected change in government spending—that is, a government spending shock—causes a change in real GDP or vice versa. First, government spending could reflect fiscal policy responses to changes in overall economic conditions; this would imply that economic activity causes government spending. Second, because people may adjust their behavior if they expect a change in future government spending, it is important to account for anticipated fiscal policy changes to capture the full effects of an unexpected government spending shock.

To identify a government spending shock, we assume that government spending does not respond to changes in real GDP within the same quarter, in line with Blanchard and Perotti (2002). This reflects the time it takes for lawmakers to decide on, approve, and implement changes in fiscal policy. We further account for anticipated changes in government spending using information from private-sector forecasts. This yields a measure of independent, unexpected changes in government spending.

We then project how real GDP will change in the future in response to the government spending shock in a given quarter using a statistical model of the Japanese economy. The model takes into account how government spending interacts with other macroeconomic variables, including lagged growth of government spending and tax revenue, lagged real GDP growth, and lagged unemployment rates.

In the final step, we compute a cumulative fiscal multiplier, which is the cumulative percentage change in real GDP over a time interval in response to a cumulative increase in government spending of 1% of real GDP over the same period. Specifically, we compute the fiscal multiplier for each quarter for up to 10 quarters after the impact of the shock. We apply this method to both the normal period from the first quarter of 1980 through the last quarter of 1995 and the ZLB period from the last quarter of 1995 through the last quarter of 2019.

Results

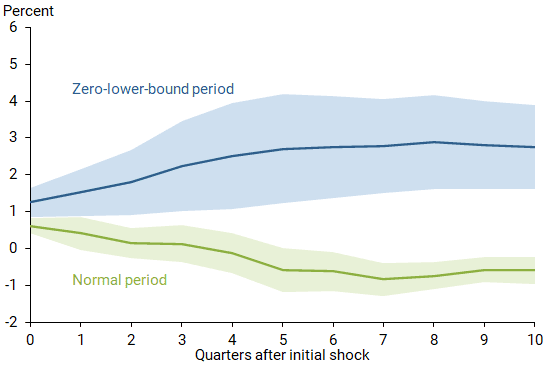

Figure 2 shows the cumulative fiscal multiplier on real GDP for periods up to 10 quarters from the impact of the government spending shock. The figure shows the estimated cumulative multiplier for the ZLB period (green line) and the normal period (blue line). It also shows the confidence bands for each, indicating the statistical uncertainty in our estimates. Specifically, assuming our model is correct, the figure shows that the shaded areas contain the actual value of the cumulative fiscal multiplier roughly two-thirds of the time.

Figure 2

Government spending multipliers: ZLB versus normal times

Note: Cumulative effects of a government spending shock on real GDP in

Japan for the ZLB period (blue line) and the normal period (green line). Shaded

areas indicate the 68% confidence band around each estimate.

The fiscal multiplier in the ZLB period is 1.25 on impact of the government spending shock, about twice as large as the multiplier of 0.62 in the normal period. Under the ZLB, the fiscal multiplier rises persistently over time, reaching levels above 2 about a year after the initial shock. In contrast, outside of the ZLB, the fiscal multiplier is transitory and becomes essentially zero about a year after the shock. The confidence bands do not overlap, indicating that the difference between the multipliers in the ZLB period and the normal period is statistically significant.

We also find that, under the ZLB, a government spending shock raises inflation expectations significantly, but it has essentially no effect on the nominal interest rate. Thus, the shock reduces the real interest rate and stimulates private consumption and investment demand, consistent with the theory.

The recessions and expansions during the ZLB period in Japan also give us the opportunity to examine potential interactions between the ZLB and business cycles. Previous studies suggest that the fiscal multiplier is typically larger in recessions than in expansions. For example, Auerbach and Gorodnichenko (2012) find that fiscal policy is much more effective in recessions than in expansions in the United States and some other advanced countries. Barnichon, Debortoli, and Matthes (2021) argue that government spending can be particularly effective during a deep recession when monetary policy is constrained at the ZLB.

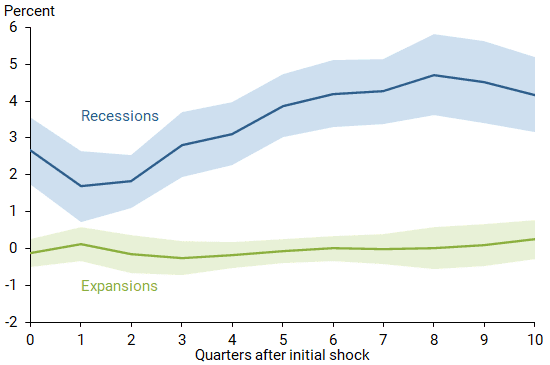

We use the sustained ZLB environment in Japan to estimate the magnitude of interaction between the ZLB and recessions. Figure 3 shows that, during the ZLB period, the government spending multiplier in recessions can be well above 2 and highly persistent (blue line). This contrasts with periods of economic expansion (green line), when the multiplier is small and not significantly different from zero. This evidence supports the idea that fiscal stimulus can be particularly effective in a recession when the monetary policy rate is constrained by the ZLB.

Figure 3

Multipliers in the ZLB period: Recessions versus expansions

Note: Cumulative effects of a government spending shock on real GDP in

Japan under the ZLB for recessions (blue line) and expansions (green line).

Shaded areas indicate the 68% confidence bands around each estimate.

Conclusion

We use Japanese data to estimate the government spending multipliers in periods when the policy rate is constrained by the zero lower bound. Our estimation suggests that increasing government spending under the ZLB can have much larger and more persistent expansionary effects on overall output than during normal, non-ZLB periods. The evidence also suggests that fiscal stimulus can be particularly effective under the ZLB when the economy is in a recession.

Our evidence from Japan should be interpreted with caution when evaluating the effectiveness of the current U.S. fiscal policy. For example, our estimates take the ZLB constraint for monetary policy as a given. However, a sufficiently large fiscal policy shock could push up inflation to a point that triggers an increase in the interest rate, which would undo some of the expansionary effects of fiscal stimulus. Also, our study does not differentiate between the effects of government consumption and government investment; as such, our findings do not directly apply to the potential impact of infrastructure spending currently under discussion in the United States.

Ethan Goode is a research associate in the Economic Research Department of the Federal Reserve Bank of San Francisco

Zheng Liu is a vice president and director of the Center for Pacific Basin Studies in the Economic Research Department of the Federal Reserve Bank of San Francisco

Thuy Lan Nguyen is a senior economist in the Economic Research Department of the Federal Reserve Bank of San Francisco

References

Auerbach, Alan J., and Yuriy Gorodnichenko. 2012. “Measuring the Output Responses to Fiscal Policy.” American Economic Journal: Economic Policy 4, pp. 1–27.

Barnichon, Regis, Davide Debortoli, and Christian Matthes. 2021. “Can Government Spending Help to Escape Recessions?” FRBSF Economic Letter 2021-02 (February 1).

Blanchard, Olivier, and Roberto Perotti. 2002. “An Empirical Characterization of the Dynamic Effects of Changes in Government Spending and Taxes on Output.” Quarterly Journal of Economics 107(November), pp. 1,329–1,368.

Christiano, Lawrence, Martin Eichenbaum, and Sergio Rebelo. 2011. “When Is the Government Spending Multiplier Large?” Journal of Political Economy 119(1), pp. 78–121.

Miyamoto, Wataru, Thuy Lan Nguyen, and Dmitriy Sergeyev. 2018. “Government Spending Multipliers under the Zero Lower Bound: Evidence from Japan.” American Economic Journal 10(3), pp. 247–277.

Ramey, Valerie A., and Sarah Zubairy. 2018. “Government Spending Multipliers in Good Times and in Bad: Evidence from U.S. Historical Data.” Journal of Political Economy 126(2), pp. 850–901.