Daniel J. Wilson

Consumer spending and business operations across the United States have been highly dependent on local conditions related to the COVID-19 pandemic. Current economic forecasts therefore must incorporate projections for where the pandemic is headed. A new econometric model provides county-level and national forecasts of COVID-19 infections. Estimates from the model indicate that population immunity acquired from prior infections is the primary driver of recent declines in new cases. This factor should continue to exert strong downward pressure on new cases in the weeks ahead.

It has been a little over one year since the COVID-19 pandemic took hold of the U.S. economy, forcing business shutdowns, school closings, and mass transitions to teleworking. Economic activity remains closely linked to the course of the pandemic. As Fed Chair Jerome Powell stated recently, “the COVID-19 pandemic continues to weigh heavily on economic activity and labor markets in the United States and around the world, even as the ongoing vaccination campaigns offer hope for a return to more normal conditions later this year.” Thus, it is crucial for both public health and economic policymakers to understand what underlying factors are driving recent COVID-19 infections and be able to forecast where infections are headed.

This Economic Letter describes an econometric model useful for forecasting COVID-19 infections at the county and national levels, detailed in Wilson (2021). I base my model on a standard SIR—susceptible-infectious-removed—epidemiological framework, using near real-time data on local mobility behavior, weather, and COVID-19 cases to date.

This data-driven, econometric forecasting approach can be thought of as a hybrid between the two general approaches used in other COVID-19 forecasts: structural epidemiological models and nonstructural machine-learning approaches. I combine the basic structural SIR model with parameter estimation based on high-frequency, geographically granular data on transmission factors and COVID-19 cases. This econometric forecast, along with an array of forecasts using the other two approaches, is included in the Centers for Disease Control and Prevention COVID-19 forecasting site.

The model forecasts a steady decline in infections through early June. Analyzing the contributing factors in the model indicates that population immunity acquired from prior infections is the primary driver of recent declines in infections and should continue to exert strong downward pressure on infections going forward.

Using an econometric approach to forecast infections

I base my forecasting model on a standard SIR epidemiological model of infectious disease spread (see, for example, Brauer, Castillo-Chavez, and Feng 2019). The SIR model posits that the growth rate of active infections for any infectious disease is determined by the current share of the population that is susceptible multiplied by the current transmission rate, which reflects how much the virus is passing from person to person.

From this basic framework, in Wilson (2021) I derive an econometric model that can be estimated with data from the start of the pandemic up to the present. The model relates the growth rate of active new infections between now and some future time horizon to the current transmission rate and the susceptible share of the population. The current transmission rate is assumed to be determined by individuals’ mobility behavior and the weather, which earlier research has found to be potentially important for the transmission of COVID-19. I measure county-level mobility using the Mobility and Engagement Index (MEI) constructed by the Federal Reserve Bank of Dallas from mobile device geolocation data provided by Safegraph. Wilson (2021) shows that other mobility data such as the Google Community Mobility Reports yield similar results. County-level weather data come from weather station readings on daily-high temperatures and precipitation from the National Oceanic and Atmospheric Administration, following the methodology in Wilson (2019).

In the model, people who have recovered from COVID-19 are treated as having long-lasting immunity from infection; therefore, the susceptible share is calculated as simply one minus the share of the local population that has previously been infected. The previously infected share captures what is known as accumulated natural immunity. However, the true share of the population previously infected is unknown due to sparse testing early on in the pandemic and asymptomatic infections. Wilson (2021) assumes that this share is a multiple, which is constant across counties, of the county’s confirmed cases per capita to date. The multiple is unspecified and captured by the econometric estimation results. In addition, the growth rate of active infections between 10-day intervals is assumed to equal the growth rate of active cases between those intervals. Data on COVID-19 cases come from USAFacts, which compiles data from state public health agencies.

Aside from mobility, weather, and accumulated natural immunity, the econometric model has two other important elements. The first is recent infection growth, which may be predictive of subsequent infection growth rates. The second is county-specific intercepts, which allow each county to have different average infection growth rates, independent of other elements of the model. These intercepts capture any unobserved or omitted factors that vary across counties but do not vary over the time frame of the pandemic, such as age composition and persistent attitudes toward social-distancing behaviors such as mask wearing.

I estimate the econometric model separately for different future periods ranging from 10 to 70 days ahead. Using data from the start of the pandemic through the latest available data yields four important results (Wilson 2021). First, increases in mobility are associated with rising COVID-19 infections over the subsequent few weeks. Second, warmer temperatures generally reduce growth rates of infections. Third, higher cumulative infections to date, suggesting accumulated natural immunity, is associated with a lower growth rate of active infections, consistent with the predictions of the SIR model. Finally, all else being equal, a higher recent COVID-19 growth rate in a county is associated with a lower future growth rate.

Forecasts based on the estimated model

The estimated model also can be used to provide forecasts of COVID-19 infections by county. These forecasts are modified to account for recent vaccinations (see Wilson 2021). Similar to prior infections, vaccinations are assumed to remove individuals from the susceptible share of the population.

A San Francisco Fed data page, COVID-19 Forecasts by County, provides the latest weekly out-of-sample forecasts by county. For the national picture, I calculate the population-weighted average of the county growth rate forecasts for each horizon from 10 to 70 days ahead. I then apply these predicted national growth rates to the latest level of national infections to yield a forecast for active new infections over the next 70 days.

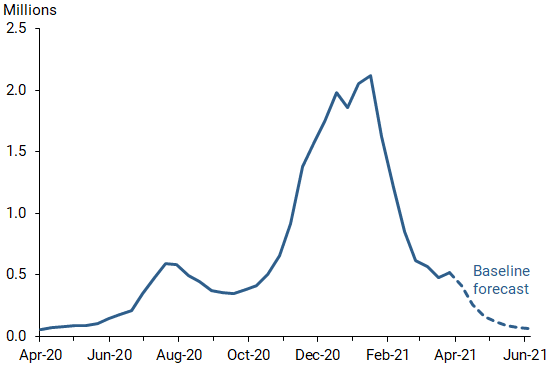

Figure 1 shows the latest national forecast, based on data through March 27, 2021, along with the historical data to date. Active infections are predicted to fall steadily through early June. In particular, the forecast predicts a 71% decline for the 30-day-ahead horizon, equivalent to a drop from approximately 18 daily infections per 100,000 persons recorded as of March 27, 2021 to around 5 per 100,000.

Figure 1

U.S. actual and projected active COVID-19 infections

Accuracy of prior forecasts

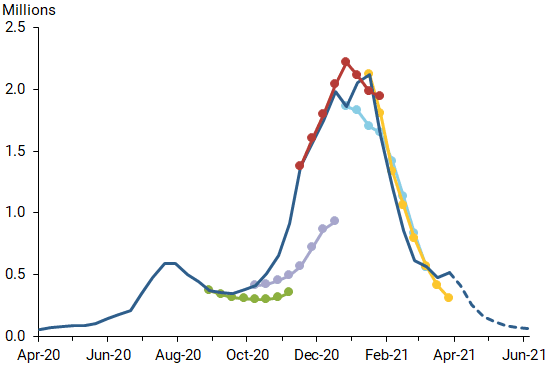

One useful way to evaluate the reliability of these forecasts is to examine how well the model performs when using past data to predict actual infections, shown in Figure 2. The solid and dashed dark blue lines represent the same actual and forecast infections as shown in Figure 1. The other lines show previous forecasts based on data and the estimated model as of the start of each forecast period, indicated by the first dot for each series.

Figure 2

Past model-predicted paths for active COVID-19 infections

The forecasts have tended to be fairly accurate and have improved over time. Notably, the forecast based on data as of November 17, 2020 (red line), when infections were increasing rapidly, predicted a continued rapid climb for the next 40 days before hitting a peak and starting to decline. That forecast proved broadly accurate except that the actual peak occurred about 10 days later than the forecast predicted.

Why are infections predicted to fall?

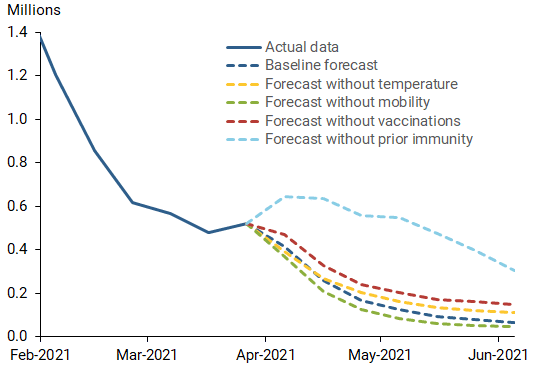

The latest national forecast predicts a steady decline in active COVID-19 infections through early June. To assess what is driving this decline, I use my statistical model to “zero out” each factor’s contribution to the forecast; comparing the result to the full model forecast yields the impact of each factor, shown in Figure 3. First, eliminating the temperature effect (gold line) yields a slightly slower predicted decline, suggesting that recent warmer temperatures are expected to lower infection rates going forward. Second, eliminating the mobility effect (green line) yields a slightly faster predicted decline, suggesting that increased mobility in recent weeks is slowing down the decline in infections. Third, eliminating the effect of vaccinations to date (red line) yields a modestly slower predicted decline, indicating that vaccinations are contributing to the forecasted decline. Yet, because the share of the population that has been fully vaccinated to date remains relatively modest, vaccinations are not the primary driver of the predicted decline in infections.

Figure 3

Key factors driving infection forecast

Note: Actual infection data for February 1 through March 27, 2021. Forecasts cover the period March 28 through June 5, 2021.

Fourth and most important, removing the effect of accumulated natural immunity (light blue line) yields an increase in predicted infections over the next month followed by a relatively slow decline. Thus, according to our model, accumulated natural immunity is the dominant driver of the forecasted decline in COVID-19 infections over at least the next 30 days.

Implications and risks

The importance of accumulated natural immunity for the projected near-term decline in infections suggests that at least some parts of the country have reached cumulative infection rates that, while not yet at herd immunity levels, are high enough to substantially push down infection growth rates. This finding has an important implication for the potential trajectory of the pandemic. So long as accumulated natural immunity from prior infections does not wane, this force should continue to strengthen, exerting increasing downward pressure on infection growth. Continued vaccinations add to this pressure.

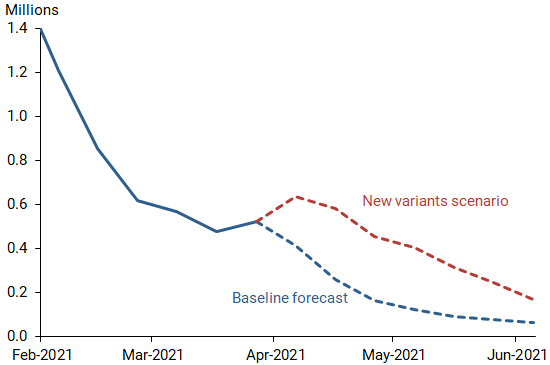

The estimated importance of accumulated natural immunity also highlights an important risk. If new variants of the virus that cause reinfections become widespread, accumulated natural immunity could decline. Some new variants also have been found to be more contagious than the original virus, implying more deleterious effects of mobility increases. I explore this “new variants” scenario in Figure 4 (red line), which amplifies the effect of mobility by 50% and assumes prior infection confers 80%, rather than 100%, protection against reinfection. In this scenario, infections rise initially, but then decline steadily, albeit at a slower pace than in the baseline forecast.

Figure 4

Baseline forecast versus scenario with new variants

Note: Actual infection data for February 1 through March 27, 2021. Forecasts cover the period March 28 through June 5, 2021.

Some other important transmission factors may not be captured by this model. In particular, there are no comprehensive county-level data to track social-distancing behaviors such as changes in local mask wearing over time, so this cannot be incorporated into the model. Widespread relaxation of such social-distancing behaviors poses a risk of slower declines, or even increases, in infections.

Conclusion

A new econometric forecasting model predicts steady declines in COVID-19 infections through early June. Accumulated natural immunity stemming from prior infections appears to explain much of the recent decline in new infections and should continue to exert a strong downward pressure on infections over the weeks ahead. Still, important risks could slow or even reverse these declines. These risks include the spread of new variants, which could cause reinfection and increased contagiousness, and relaxation of social-distancing behaviors such as mask wearing.

Daniel J. Wilson is vice president in the Economic Research Department of the Federal Reserve Bank of San Francisco.

References

Brauer, Fred, Carlos Castillo-Chavez, and Zhilan Feng. 2019. Mathematical Models in Epidemiology. New York: Springer.

Wilson, Daniel J. 2021. “Weather, Mobility, and COVID-19: A Panel Local Projections Estimator for Understanding and Forecasting Infectious Disease Spread.” FRBSF Working Paper 2020-23 (February 2021).

Wilson, Daniel J. 2019. “Clearing the Fog: The Predictive Power of Weather for Employment Reports and their Asset Price Responses.” American Economic Review: Insights 1(3, December), pp. 373–388.