Editorial: Is the Fourth Time the Charm?

Argentina submitted its fourth sovereign debt restructuring proposal under foreign law. This time it smells like a goal, but the ball still has to hit the net. Not only has it improved the financial terms, but it has also made legal concessions that make it attractive to many bondholders, although the last word has not yet been uttered, and we will have to wait for BlackRock's reply and especially the one from creditors who hold bonds from the 2005 swap.

The proposal will be valid until August 4 and will be executed on September 4. It is likely that some additional adjustments will be required before claiming victory. The markets have had a positive outlook on this matter and there have been considerable hikes in bonds and stocks. Our base scenario is positive, but it is not a done deal.

The valuation of this offer, considering a discount rate of 10%, is around USD 53, in line with the proposal of one of the creditor groups. This is an marked improvement to the original offer that was valued at USD 40 and that had allegedly had a 15% acceptance. In this offer, the capital cuts are lower, the coupons are higher and the payment terms shorter than in the previous proposals. In this offer, there is no GDP coupon and no payments tied to exports.

Some features worth highlighting: The government has kept the 2005 indenture for those who hold those bonds, ironing out one of the legal problems that had arisen in recent weeks. Those bonds will still be difficult to restructure. Secondly, the government will pay for all accrued interest until April 22 (when it fell into default) through a bond with 1% interest maturing in 2030. There is an incentive to participate: those who accept Argentina's terms (as opposed to those who may be swept away by the collective action clauses) are granted interest between April 22 and September 3. This is worth about 1 dollar more.

An additional issue is that the government will set minimums for participation, which are not yet known. This means that if the acceptance is less than a number of say 60 or 65%, the debt swap will not take place and it is back to the negotiation table. This is important because before you could accept and you were left with very illiquid bonds.

Which are the risks of this offer not obtaining the consensus to move forward? One is that the investors that hold 2005 swap bonds say they have enough to prevent Argentina from reaching the minimums of the collective action clauses set at 85% for these bonds. For the bonds issued under the Macri administration, for which Argentina has to obtain 66% of the total and 50% of each bond, the chances of success are much higher, although the Ad-hoc group will have to be seduced to endorse the proposal and push other investors into joining in. The worst scenario would be that 25% of the creditors of a series get together and accelerate, but this does not seem to be the direction in which creditors are moving.

Is there a chance of having holdouts? Yes. If Argentina does not reach the anticipated minimums in the CACs but exceeds the self-imposed threshold of hypothetically 60/65%, there could be holdouts. Investors will be protected through a RUFO clause that would guarantee them equal treatment as long as the holdouts get better terms. This would mean that Argentina would continue to default and the objective of substantially lowering country risk would not be achieved, as the Dominican Republic, Ukraine and Uruguay, who managed to do so after one year of restructuring, reducing it to 800 points.

The million-dollar question is if a successful restructuring will be followed by other micro and macroeconomic measures that help to consolidate a vision that will encourage the private sector to invest.

What’s coming up this week…

- The May industrial production index will be released today. We are sure there will be a rebound from the April low, although it will logically be a very sharp y/y drop. Given its weight on activity, the IPI will help us forecast May’s monthly recovery for the entire economy.

- The construction activity index will be also released today. Although very weak y/y figures are expected, there should be a strong m/m recovery as, for example, cement dispatches grew over 50% in seasonally adjusted terms.

Despite the Money Issuance, the Sterilization Effort Continues

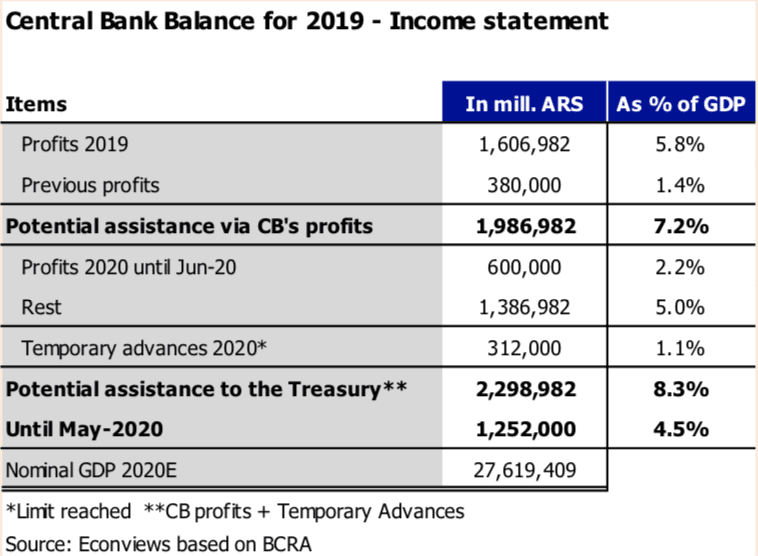

- The CB is still making an effort to absorb pesos via Leliqs and reverse repos: throughout the first half of the year, the monetary base has grown scarcely ARS 269 billion while assistance to the Treasury has surpassed ARS 1.2 trillion

- Countering this effort, the interest generated by the CB’s liabilities is starting to encumber

- We expect the monetary base to grow 50% during the year, assuming that the CB keeps financing the Treasury with up to 6 points of GDP, purchases reserves during the second half of the year and sterilizes the remainder

In June, monetary assistance from the CB to the Treasury via profits totaled ARS 200 billion. Thus, it turned out to be lower than in April and May, when activity had fallen the most due to the pandemic, causing a drop in tax revenues and increasing the need for social spending. Nevertheless, it is likely that monetary assistance will increase again in July, consequence of AMBA returning to a stricter quarantine, which will entail another drop in tax revenues.

Back to June’s performance, the monetary base grew ARS 33.2 billion, with the CB’s profit transfers to the Treasury as the main expansionary factor and Leliqs being the main contractionary factor with ARS 335 billion. In this sense, it was still remarkable that the monetary base has only grown ARS 269 billion this year while assistance to the Treasury surpassed ARS 1.2 billion, with an ARS 889 billion sterilization effort via Leliqs from the monetary entity (in addition to ARS 306 billion through reverse repos).

However, since the need to sterilize pesos will still be there during the months to come, and because the interest rate might go up (as it was pointed out during the last Treasury Bill auction of last week), interest starts gaining importance. In fact, out of the ARS 1.2 trillion that have been absorbed via Leliqs and repos so far this year, around ARS 300 billion were generated in concept of interest (that is, 25% of what was sterilized), even with an interest rate that is not so high in real terms, as it has been during the near past.

Conversely, a potential drop in reserves purchases from the CB will cause less monetary expansion and, therefore, less need to sterilize compared to a scenario in which the trade surplus is purchased every month, with strict FX controls. In fact, during the first half of the year, the monetary entity practically could not accumulate reserves (it scarcely purchased USD 105 million net), although it was able to resume purchasing in June after tightening the cepo (USD 672 billion).

This way, we expect the monetary base to grow in line with this year’s inflation, around 50% yearly. The main expansionary factors will be assistance to the Treasury and the potential reserves purchases during the second half of the year. Consistent with it, the CB will have to keep sterilizing via Leliqs at the same pace it is currently doing so. This would cause monetary liabilities to be around 10% of GDP by the end of the year. If not, the monetary base should grow over 50% yearly. Another issue to highlight is that the CB will have to consider the load of interest in 2021.

Revenues Fell Again Strongly in Real Terms in June

- They amounted to ARS 546 billion and grew 20.1% compared to June 2019, contracting 15.7% in real terms

- The main taxes that are shared with the provinces, linked to the domestic market, strongly declined: VAT-DGI grew scarcely 3.9% y/y and Income Tax did so 9.8%

- Taxes levying foreign trade recovered after May’s poor performances: export taxes grew 28.1%, import taxes 13.7%, and VAT-DGA 26.5%

- The revenues accumulated during the first half of 2020 grew scarcely 26.7% compared to the same period one year ago

Despite reducing the magnitude of their falls from the past two months, tax revenues grew again way below June’s inflation. On the one hand, the easing of the quarantine in AMBA and the advance to the social distancing stage in a great portion of the country, together with more people complying with the several payment plans to settle their unpaid taxes, contributed to reducing the real fall of revenues. However, the lockdown’s negative impact, although moderated by the increased flexibilization, continued to affect taxes linked to the domestic market especially, as they are strongly tied to the evolution of consumption and employment. As for taxes levying foreign trade, they have overcome the nominal falls recorded in May and, on average, grew in line with total revenues, although they are still showing some weakness.

In June tax revenues amounted to ARS 546 billion, 20.1% over their level one year ago. This result implied a fall in real terms around 15.7% according to our estimations, becoming the sixth consecutive one. Particularly, VAT-DGI and Income Tax, which make up for almost half of total revenues when combined, recorded a 25% real worsening on average once again.

Taxes linked to the domestic market, which are the ones that represent practically all the base that is transferred to provinces, grew again way below inflation. Particularly, VAT still has not recorded real positive variations so far this year and has grown scarcely 3.9% in nominal terms compared to one year ago. In fact, June’s poor record has been the best of the last three months. In addition to the effect caused by the drop in consumption during the lockdown, the revenues concerning this concept eroded again, although much less than before, given the increase in compensations toward taxes such as Income Tax or Fuels Tax.

As for Income Tax, it stood scarcely 9.8% over its level one year ago, affected by several factors: last year’s real earnings were smaller than in 2018 ─balance sheets deflated with 2019’s inflation, the highest on record since the 90s─ thus decreasing the tax base; the non-taxable base was increased; the rates table was updated; and both advances for individuals and rates for societies were decreased.

As for Social Security, its revenues recorded a 22.4% rise after growing 11.6% in May, although they were still far from the 40% rise scored in March. Thus, their fall reached 14.1% in real terms, hand in hand with the 95% reduction in the rate for essential sectors, the suspensions of employees (who were paid less than usual), and the greater amount of layoffs in sectors that had already been dragging a strong recession. On the other hand, although the time extension to pay for employer contributions that was set by the Government for the activities most struck by the crisis expired in June (so April’s contributions had to be paid), AFIP has created a special payment plan that offers up to two extra months before starting to pay for the postponed contributions during each fiscal period. Thus, those taxes accrued in March, expired in April, and postponed until June, which are settled using this mechanism, will start being cancelled in August.

Meanwhile, the tax on Credits and Debits grew 23.9% compared to one year ago, managing to partially moderate the negative effect caused by the weaker consumption and positioning itself as one of the most dynamic taxes levying the domestic market, thanks to the greater use of e-payment methods.

Taxes linked to foreign trade were able to get past the falls they recorded in May and, on average, grew in line with total revenues. Although they were still affected by the drop in traded volumes due to the high FX spread (it averaged 81% in June), which led exporters to keep delaying their sales, waiting for an eventual correction and increase in the official exchange rate, export taxes grew 28.1% compared to the record a year ago, after falling 35.6% in May. It is worth mentioning that despite rates going up compared to June 2019, the comparison basis from a year ago includes taxes of a record gross harvest. As for import taxes, they grew 13.7% in a month in which the volume of imports plummeted again, while VAT-DGA grew 26.5%.

Lastly, among the taxes that contributed toward improving the y/y performance of tax revenues, the tax on personal assets stood out again, growing almost 300% due to the increase in rates, and due to the P.A.I.S. tax, which amounted to ARS 14.1 billion, led by the greater dollar purchases for hoarding and the payment of foreign services.

In this scenario, automatic transfers to provinces amounted to ARS 200.4 billion in June, growing 26.3% compared to a year ago, which means a real fall around 11.3%.

This way, during the first half of the year, tax revenues went up 26.7% compared to the same period in 2019. Taxes linked to foreign trade grew 29% on average, while the ones linked to the domestic market were 26% over their level from the first half of 2019. In July, the fall in revenues in real terms will feel the impact of the stricter lockdown in AMBA, though we expect the damage to decrease as the Government keeps on allowing activities in provinces and resuming the relaxation in AMBA.

The Current Account of the Balance of Payments Had Its Best First Quarter Since 2009

- It recorded a USD 444 million deficit, against a USD 3.5 billion deficit one year ago

- In addition, it recorded USD 780 million in net inflow to the financial account with USD 1.2 billion in financial assets net sales and USD 478 million by cancelling liabilities

- Foreign debt reached USD 274.2 billion during the first quarter, below the USD 277.6 billion from the previous quarter

The estimations on the balance of payments corresponding to Q1-2020 resulted in a USD 444 million current account deficit, being the best record for the first quarter since 2009. During the first three months of last year, the current account had accumulated a USD 3.5 billion deficit.

In a context in which economic activity has been depressed and with a virtually stable exchange rate, the goods account recorded a USD 3.7 billion surplus (compared to USD 2.5 billion one year ago), with USD 13.2 billion in exports and USD 9.4 billion in imports. On the other hand, the services account recorded a USD 862 million deficit, some USD 923 million below the one from the same period in 2019, especially due to a reduction in the tourism deficit. In turn, net outflows via revenue rose to USD 3.6 billion, just over USD 900 million below the outflows recorded during Q1-2019. Lastly, inflows via current transfers amounted to just USD 314 million, although they surpassed their USD 279 million record from last year.

As for the capital account, it totaled USD 25 million in inflows, so financing needs reached USD 419 million during the first quarter of the year. A year ago, said amount had been USD 3.5 billion.

As for the financial account, USD 780 million in net inflows were recorded after the USD 3.6 billion from a year ago. Particularly, there were net inflows through both direct foreign investment in the country (USD 901 million) and portfolio investment (USD 842 million). Also, another USD 2.0 billion were recorded in net outflows, mainly currency and deposits, greater loan and credits payments and trade advances, and net debt settling regarding loans from international bodies.

In addition, reserve assets decreased USD 1.0 billion, which, together with the differences between currencies that involved a USD 198 million drop, accounted for the USD 1.2 billion reduction in the CB’s international reserves, dropping to USD 43.5 billion as of March 31 2020.

Lastly, foreign debt amounted to USD 274.2 billion, below the USD 277.6 billion from Q4-2019. This decrease was mainly due to the Government’s general debt reduction of USD 2.6 billion and a UDS 1.3 billion reduction in the CB’s debt. As of March 31 2020, 62% of the debt corresponded to the general Government, 26% to non-financial Societies, homes and NPISH, 8% to the CB, 2% to Societies that receive deposits, and the remaining 1% to other financial societies.