London 7/7 | Betting On ‘Bad’ Outcomes

Is it ethical or acceptable to bet on disasters?

Part IV: The Trades | Is This The End of American Exceptionalism?…No

Best Long & Short Strategies 2025Q2/3

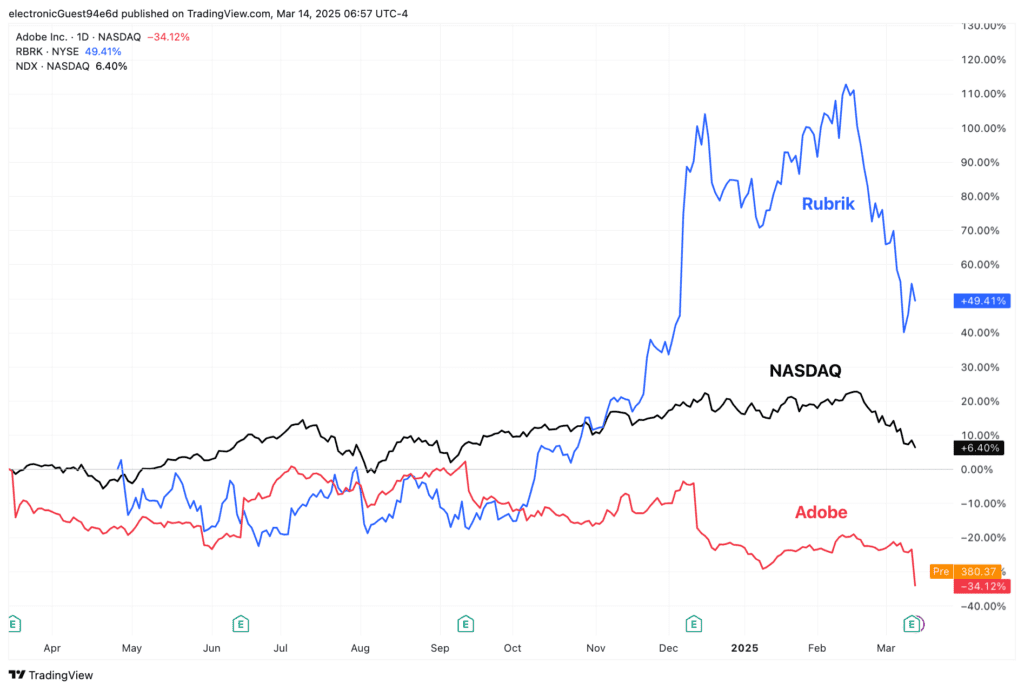

Rubrik | Adobe | AI Barbell | Macro Insights

Barbell approach to AI. Other bits and pieces

US Equities | Time to Cover Shorts and Dip Into Longs

A pattern to the chaos… cautiously optimistic near-term

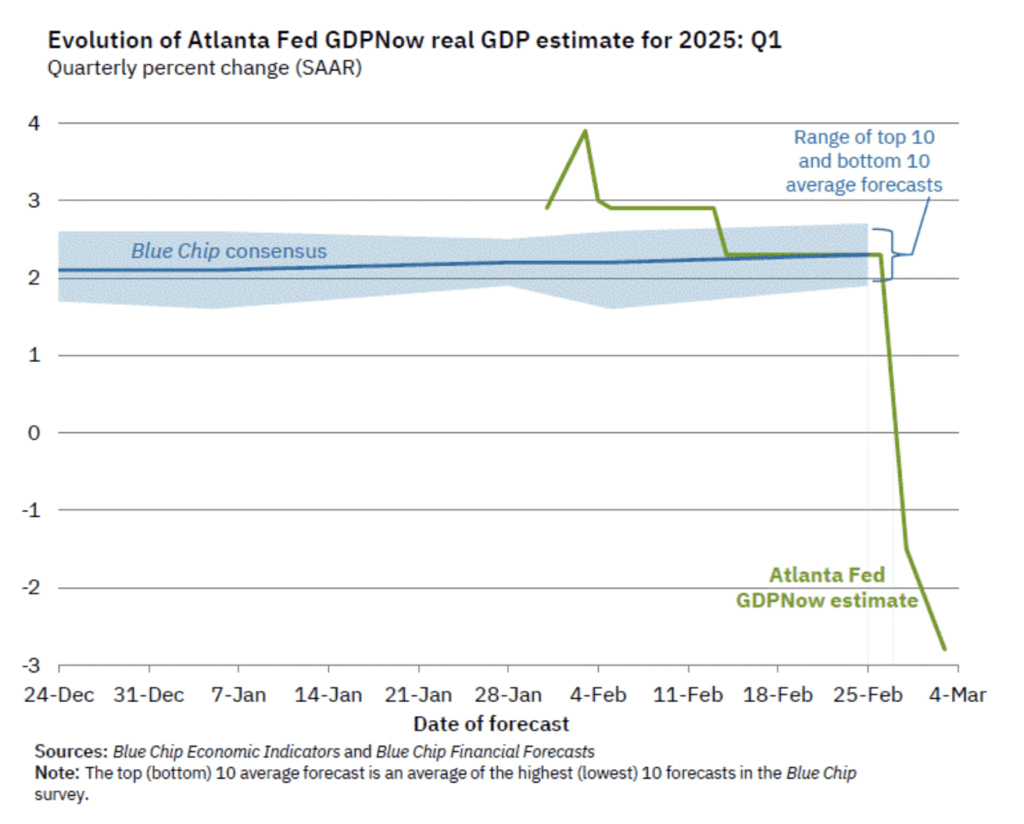

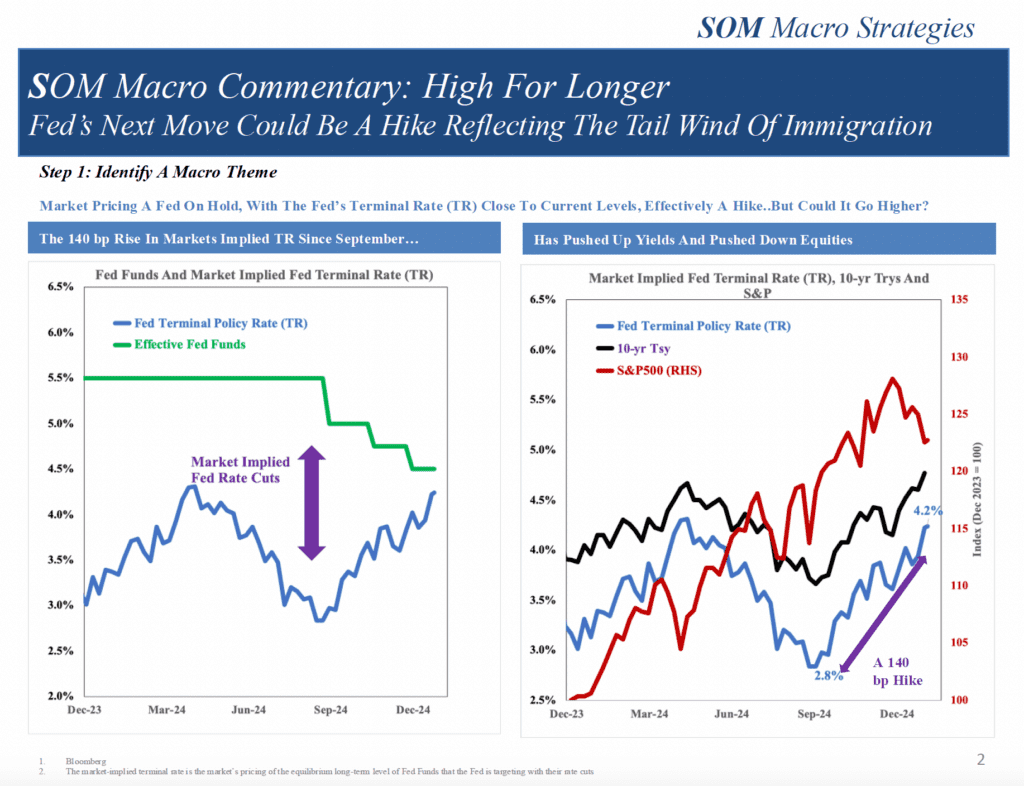

US Macro | Higher For Longer

Fed’s Next Move Could Be A Hike Reflecting The Tail Wind Of Immigration

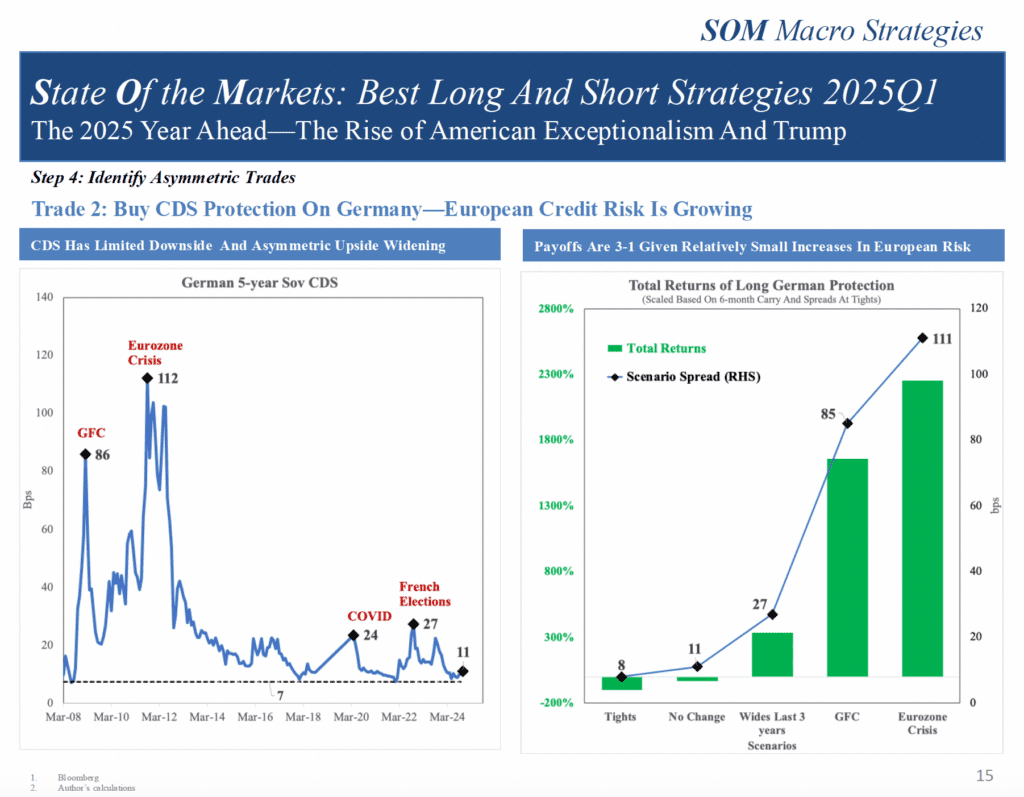

SOM Year Ahead: The Rise of American Exceptionalism And Trump

Best Long And Short Strategies 2025Q1

Trade Update & Historical Performance

Recent and historical performance of SOM trades

US Yield Curve | Veterans/Remembrance | NextFedChair.com

US yield curve and next Fed Chair back in focus

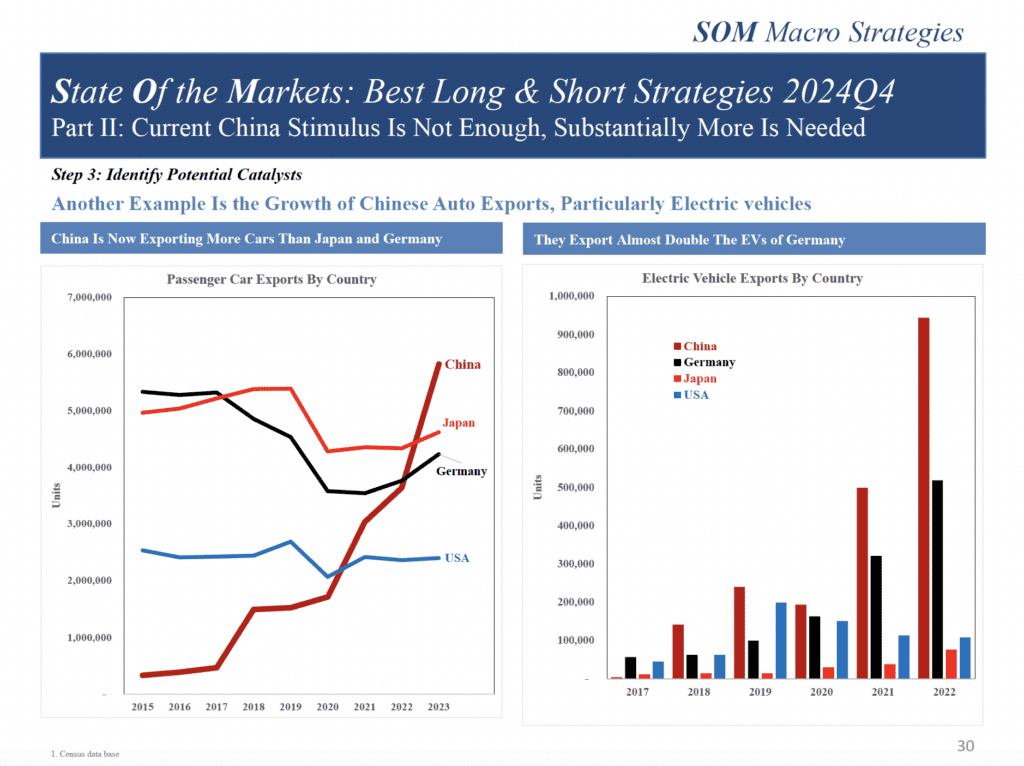

Part II: Current China Stimulus Is Not Enough

Substantially more is needed

REPOST | China Needs Stimulus Because It Is Becoming Japan

Become a member to read the rest of this article Username or E-mail Password Remember Me Forgot Password