Iranium Crypto | Iran-Israel | FOMC | Tariffs

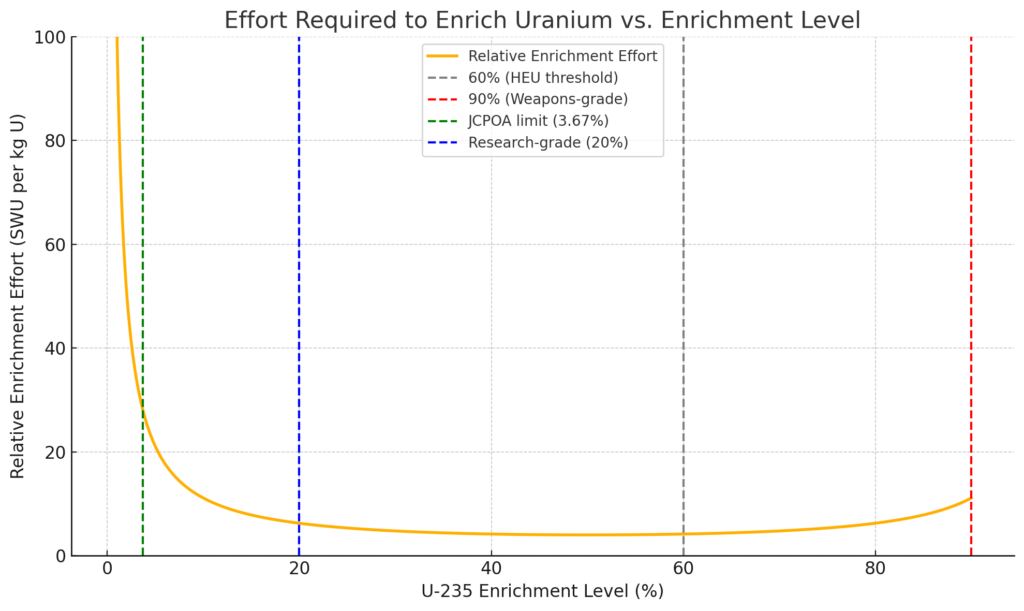

It’s Shah Mat or Amalek! Trump tantrums on Iran… but why?

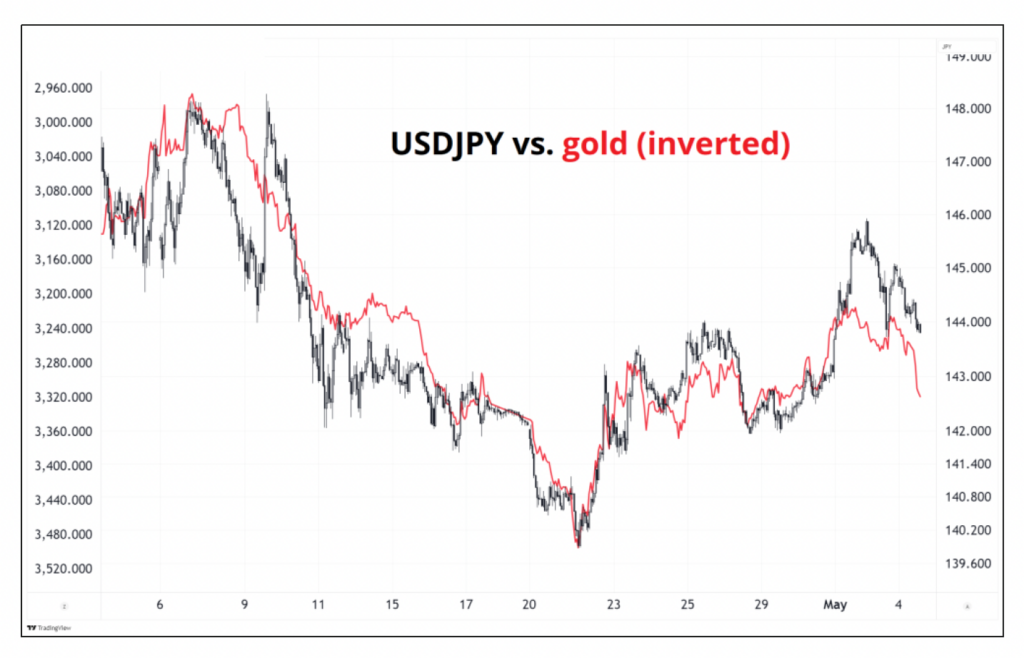

Brent Donnelly | Time To Reload USD Shorts

Six reasons to jump back in the pool

Grifols | MicroStrategy | BTC | Convertibles

Tim Hall on MSTR stock valuation. Grifols buyer flakes.

Trade Update & Historical Performance

Recent and historical performance of SOM trades

DOGE | Draghi | Doge of Venice | DeFi | Dodging Tariffs

Time to get rich or die trying? System takedown

DOGE | Is The Musk/Dorsey Crypto Masterplan Still On?

Dogecoin re-catches a bid. Time to sell, hold or buy more?

Spectra Markets | EURUSD, Consumer Confidence, and Yields

Become a member to read the rest of this article Username or E-mail Password Remember Me Forgot Password

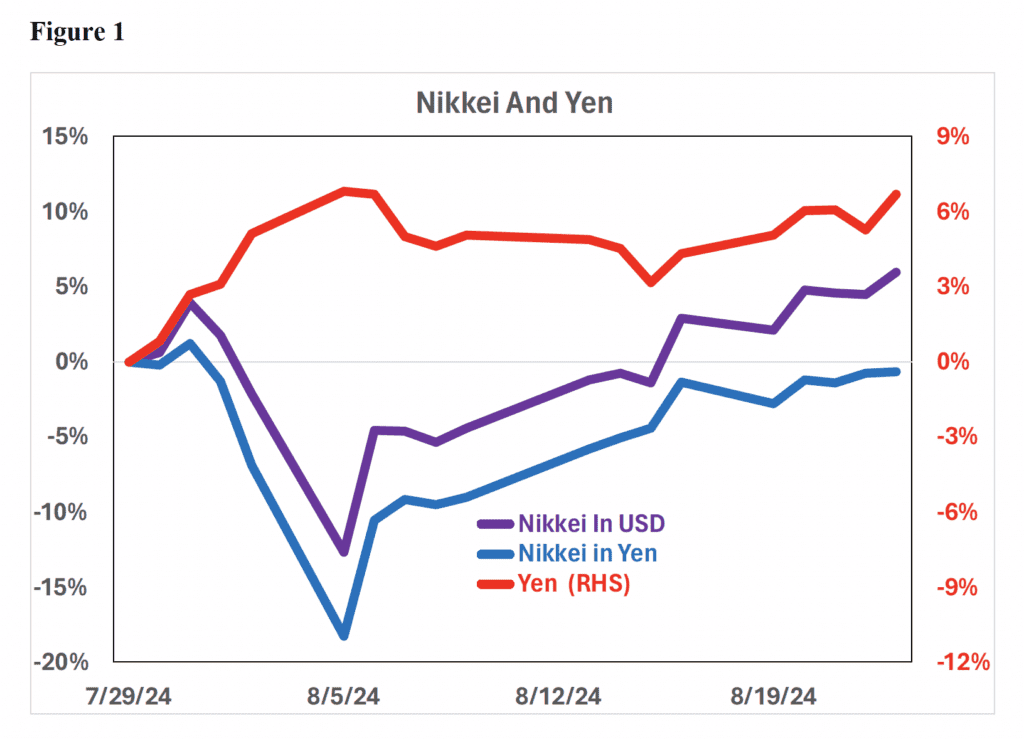

Update On Recommended Trades

I closed my long Yen call on August 6th after the Yen’s rally. The trade was up almost

seven times versus the initial investment.

Brent Donnelly | NZDUSD | Technicals

Still not a believer in the sustainability of this USD selloff

Yen Carry-Out | US Election | Middle East | Monkey Business

Topped and tailed carry-out trade. Harris now favorite to win in betting markets