AI | Nvidia | Baupost-Klarman ‘Margin of Safety’ | Boston Bombing

From AI to amateur psychoanalysis. We honor the “special ones”

Trump’s Handwritten Note to Powell: Lower Rates Abroad, So Why Not Here?

Do lower interest rates in other countries really mean the Fed is too tight?

Iran–Israel | Part 1: Ex-UK Intelligence Perspective

What means ‘winning’?

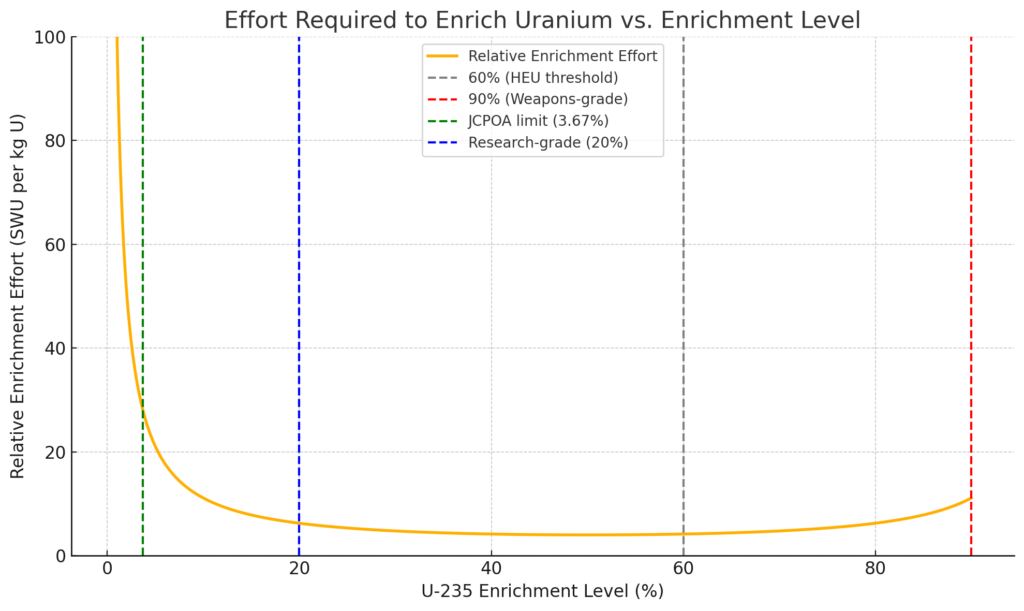

Jeff Lewis | US-Iran | Preliminary Assessment of Fordow Strikes

OSINT battle damage assessment

Iran-Israel | Updates – June 23, 2025

Real men fly to Tehran…

Iranium Crypto | Iran-Israel | FOMC | Tariffs

It’s Shah Mat or Amalek! Trump tantrums on Iran… but why?

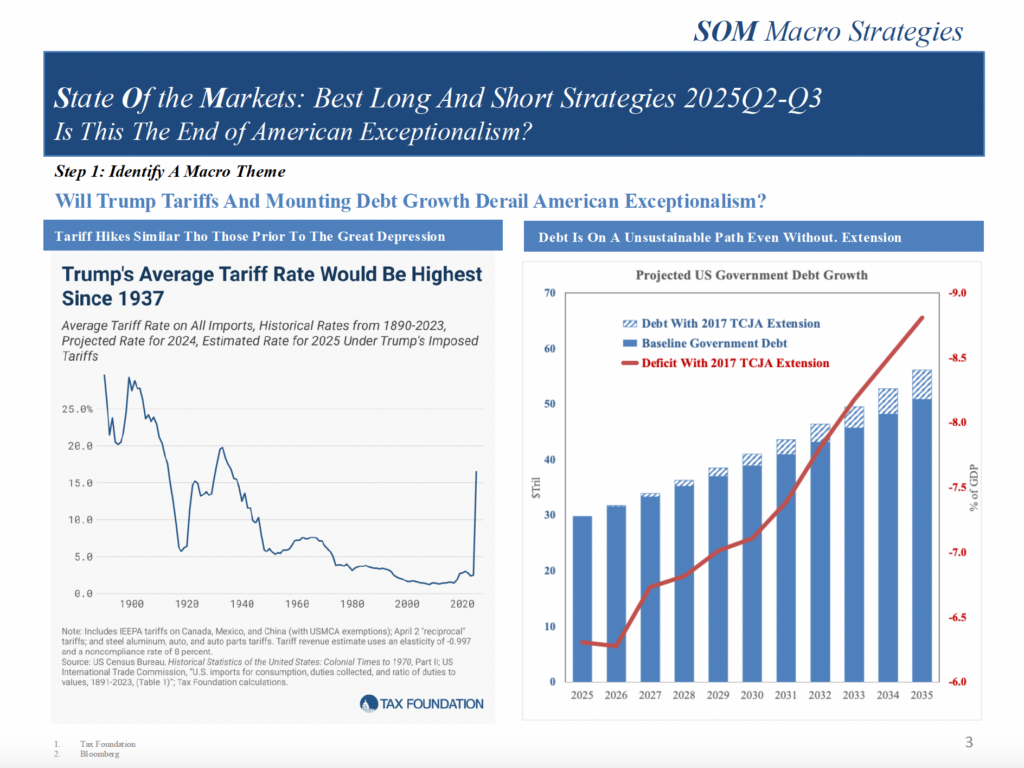

Part IV: The Trades | Is This The End of American Exceptionalism?…No

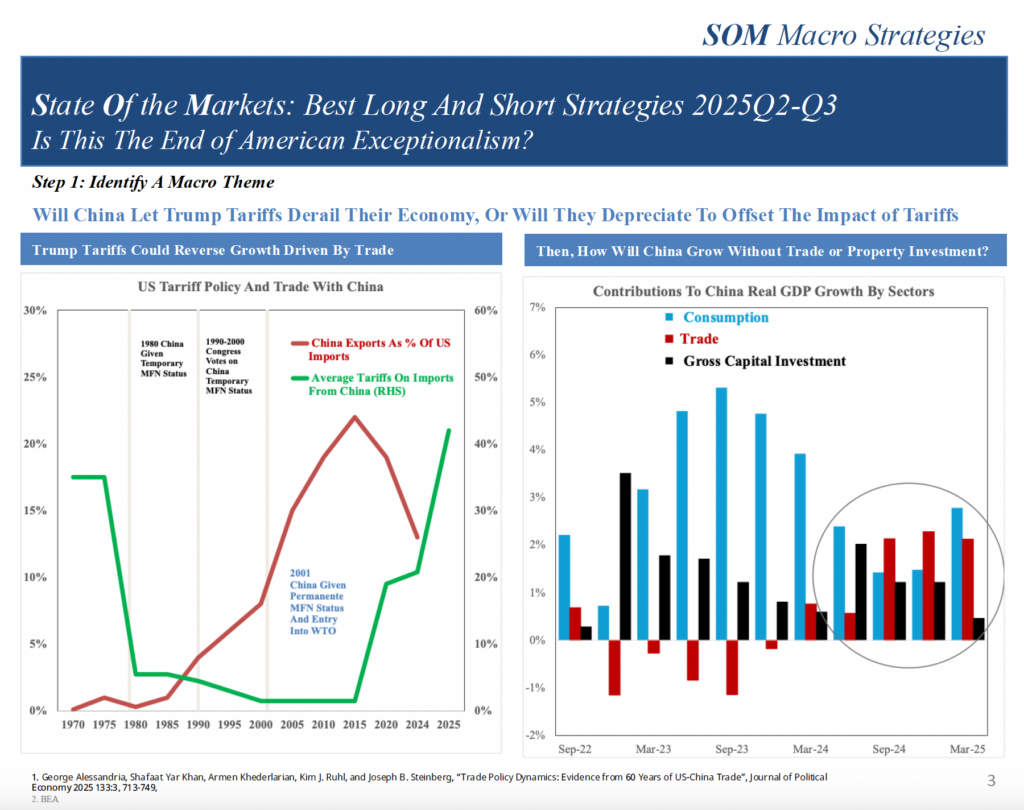

Best Long & Short Strategies 2025Q2/3

Part III: American Exceptionalism Continues And Gains Steam

The Era of America’s Economic Exceptionalism Is Not Over

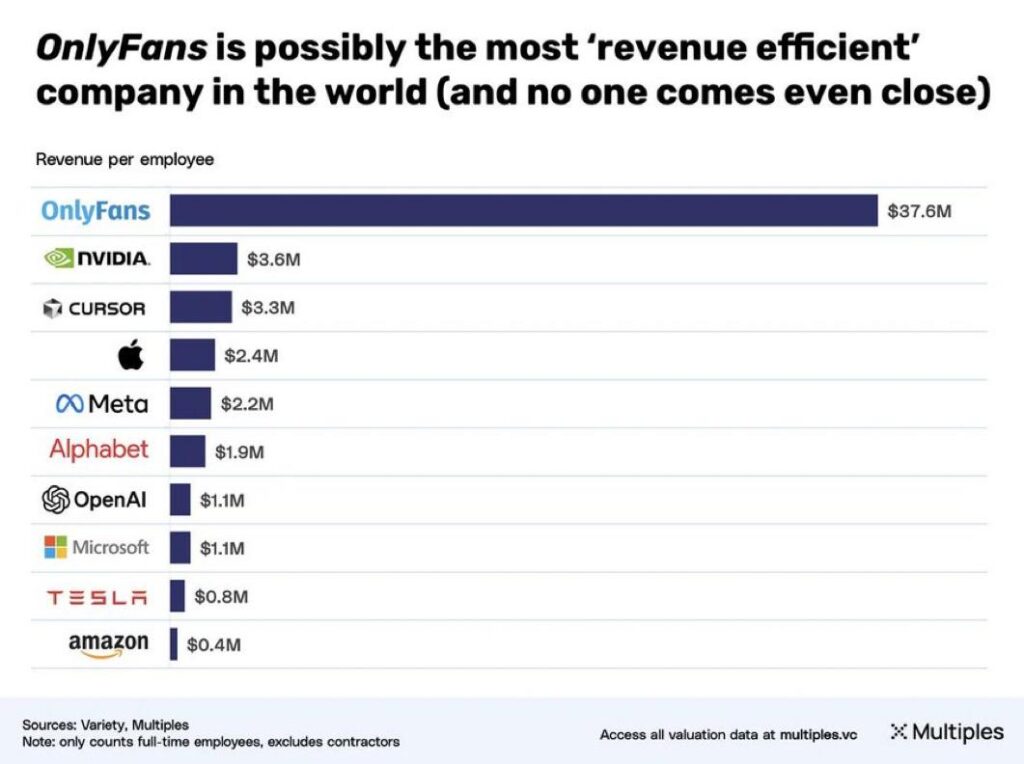

Markets | Fed Spy | US-Japan | Tariffs | Rubrik | Quantum

Fed spies and mail-ordered brides. Market update

Part II: China Goes All In On Trade And Depreciates The CNY

Is This The End of American Exceptionalism?