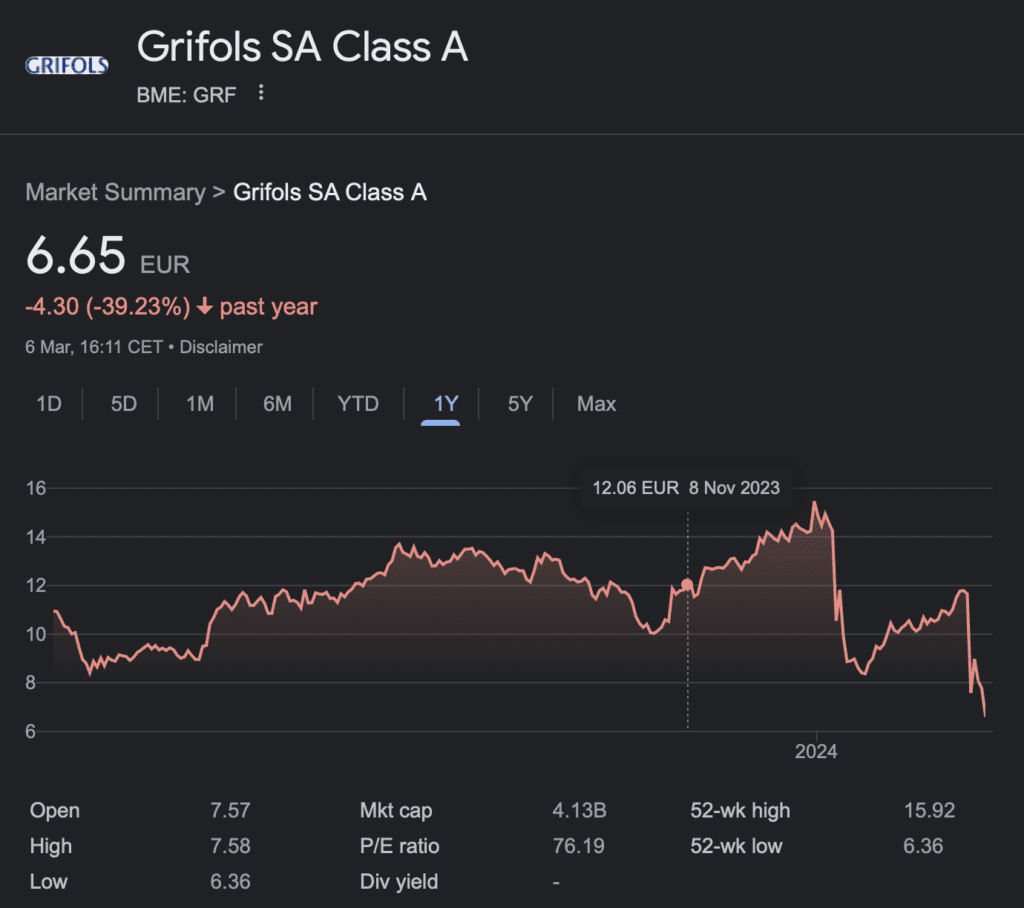

Grifols: first missed, then dismissed

We previously forgot to mention that our beloved Grifols SA stock got hammered again late last week after the company admitted to financial wrongdoing:

Another one Wall Street's finest and brightest first missed, and later dismissed. They're supposed to be experts in reading company financials. We don't make them look silly, they do it to themselves.

Congratulations to the couple of people on here who kept your nerves during the short squeeze.

Markets

If we follow the standard script, events should unfold as follows:

Equities

The best-performing tech stocks will pare back some recent gains. Traders, once again excited, will proclaim the end of the Big Tech AI hype bubble and begin to short stocks. Corporate treasury departments will seize the opportunity to buy back billions of shares while the offer stands, inevitably causing a short squeeze. They execute their strategy much more effectively than most Wall Street investors. Most corporate treasurers are also keen to lock in interest rates on excess cash balances.

Fixed Income

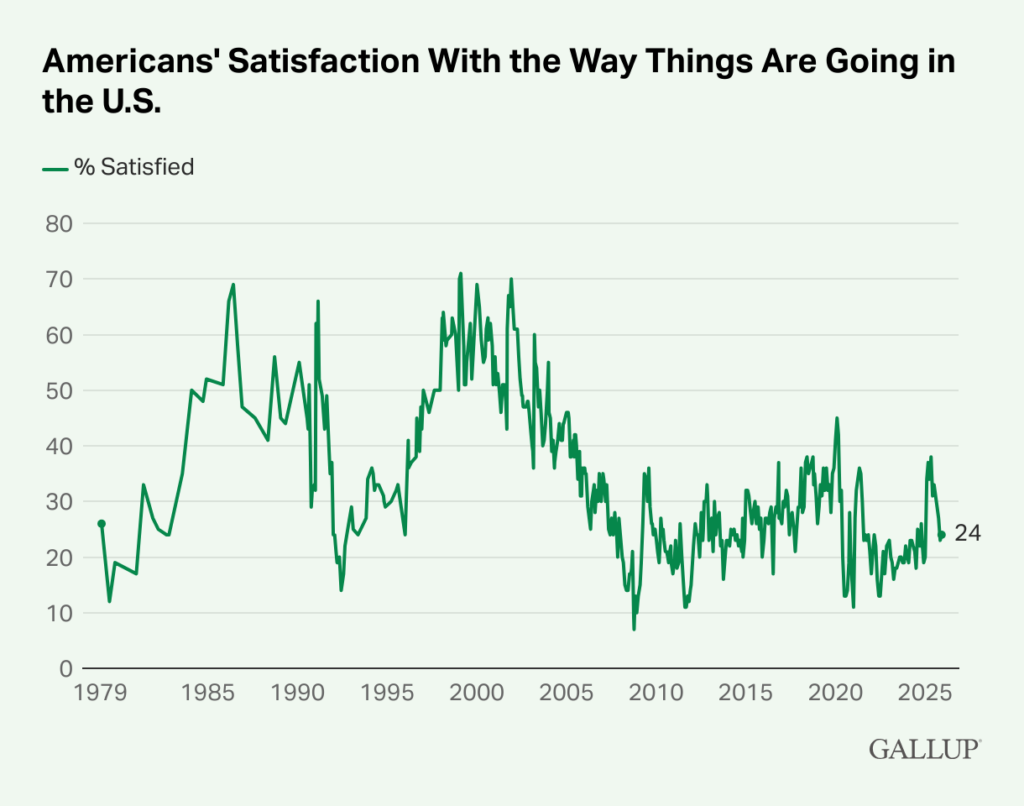

Treasury yields will decline for no apparent reason. By the time 10-year yields retest 3.7%, we can recycle the same market commentary from late December and early January; the bond bulls will reemerge. Several market economists will undoubtedly present a compelling thesis for the end of the inflation cycle and why the Fed should cut interest rates five or more times in 2024.

Rinse and repeat the cycle.

Undoubtedly, along the way, a few individuals will interpret a couple of additional Fed rate cuts as highly consequential to Nvidia's bottom line.

For now, USD rates continue to rally:

Another lay up trade about to be missed. Only in hindsight to be told it was very obvious.

Here's a reminder of the short and long-term interest rate pair combination matrix we constructed back in late December:

Three Macro Themes Repricing Assets And Driving Economic Growth