Vasco Cúrdia

The Federal Reserve adopted average inflation targeting as part of its long-run monetary strategy framework in 2020. This strategy allows inflation to rise and fall such that it averages 2% over time. Analysis shows that a version of average inflation targeting that is partly forward-looking—that is, one that responds in part to expected future inflation—could have improved economic outcomes in the recovery from the financial crisis of 2008, as well as substantially reduced the uncertainty around economic outcomes.

The Federal Reserve kept its key short-term interest rate, the federal funds rate, near zero for seven years during the recession and economic recovery from the 2008 Global Financial Crisis. During this time, inflation stayed stubbornly below the 2% target set by the Federal Open Market Committee (FOMC).

Researchers such as Ajello et al. (2020) have analyzed how a low natural rate of interest combined with the zero lower bound (ZLB) on the nominal federal funds rate make it more difficult for the Fed to resolve the tradeoffs between the dual mandate goals of stabilizing inflation and achieving maximum employment. In response to this environment, average inflation targeting (AIT) emerged as a possible strategy to mitigate the effects of the ZLB, as discussed in Mertens and Williams (2019). The FOMC incorporated AIT in its updated statement on longer-run goals and monetary policy strategy at the conclusion of its yearlong framework review (Board of Governors 2020).

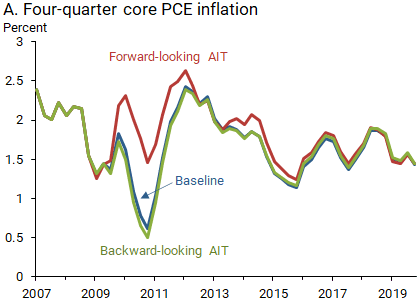

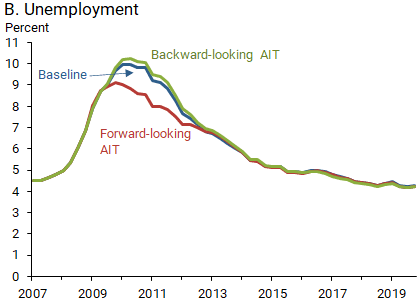

In this Economic Letter, I use an empirical model of the U.S. economy to evaluate how using AIT immediately following the financial crisis could have led to different economic outcomes than those observed. My analysis suggests that AIT would have pushed average inflation up to 2.1%, half a percentage point higher than its baseline average for 2009–11. Additionally, AIT would have pushed the baseline average unemployment for that period down to 8.4%, nearly a full percentage point lower. Importantly, these benefits depend on incorporation of forward-looking expected average inflation into policy, with a much more limited boost to the recovery occurring if a backward-looking measure is used.

Incorporating AIT into monetary policy could have had another important effect by alleviating some uncertainty regarding the economic outcomes during this period. The analysis considers how uncertainty about underlying conditions translates into economic outcomes and finds that forward-looking AIT would have reduced uncertainty about outcomes by two-thirds relative to the baseline policy strategy.

Average inflation targeting in a macro model

To compare the outcomes of alternative policy strategies, I use the empirical model described in Ajello et al. (2020) to construct possible scenarios. This is based on a standard macroeconomic model commonly used to analyze monetary policy.

A main component of this model is economic slack, or the unused potential in the economy. For this component, I use the unemployment gap, the difference between current unemployment and a hypothetical level that would prevail in an economy in which companies operate at their full capacity; in such an economy, prices adjust freely in response to unexpected changes in conditions and some unemployment may still exist. The inflation-adjusted federal (fed, for short) funds rate that would be consistent with that economy, known as the natural rate of interest, is a useful benchmark for monetary policy. In the model, the unemployment gap rises with the gap between the inflation-adjusted, or “real,” fed funds rate and its natural rate. The intuition is that a positive interest rate gap means that financial conditions are tighter, leading households and firms to save more and delay consumption and investment. This lowers demand and increases unemployment. Inflationary pressures fall with economic slack and rise with expected future inflation.

Another component in the model is the baseline rule used to guide monetary policy. That rule assumes that the fed funds rate responds to a combination of the natural rate of interest, how much four-quarter inflation deviates from its 2% target, and the unemployment gap. It also assumes that interest rates adjust gradually and acknowledges the influence of FOMC communications about the expected future path of interest rates, known as “forward guidance.”

In this analysis, I consider two scenarios for incorporating average inflation targeting into the baseline model. First, a simple backward-looking AIT considers the same baseline policy rule, except that the fed funds rate responds to the average deviations of inflation from the 2% target over the previous eight quarters, rather than only the previous four. A longer view of past inflation deviations from the target means that policy will respond for a longer period of time to past misses and thus will provide additional accommodation when the ZLB is a constraint on the nominal federal funds rate. Another option relies on forward-looking AIT; it considers a rule that responds to the current four-quarter inflation deviations from target, as in the baseline, and also responds to expectations of what average inflation will be in the coming four quarters. This approach focuses less on responding to the past and more on responding to the ongoing and expected future pressures on inflation. In other words, past economic disturbances matter only to the extent that they are expected to impact future inflation. Importantly, in each scenario, the analysis assumes that households, firms, and financial markets fully understand the monetary policy rule in that scenario.

Quantifying the impact of average inflation targeting

I use data from 1987 through the second quarter of 2019 for core personal consumption expenditures (PCE) price inflation; real GDP growth; the unemployment rate; the effective fed funds rate; estimated long-run unemployment rates from the Congressional Budget Office and the Fed’s Summary of Economic Projections; and fed funds rate expectations derived from financial data based on Christensen and Rudebusch (2012).

To evaluate how well different policy strategies would have performed in the aftermath of the 2008 financial crisis, I estimate the factors determining the evolution of the U.S. economy from 2008 through 2019. Then I consider how the economy would have reacted if policy had started following the two alternative strategies in the first quarter of 2009 while accounting for the estimated underlying economic conditions in that period. I focus the analysis of subsequent outcomes on the years 2009–11, when AIT could have made the largest impact.

Figure 1 shows the median simulated paths of inflation (panel A) and unemployment (panel B) under alternative policy strategies: the baseline historical policy (blue lines), the forward-looking AIT (red lines), and the backward-looking AIT (green lines). The backward-looking AIT that averages inflation over the previous eight quarters is not very different from the baseline policy that averages over the previous four quarters. The reason for this is that averaging inflation over a longer period of time allows policy to respond to weak inflation for longer periods, but it also delays the response when weak inflation begins to appear.

Figure 1

Simulated inflation and unemployment paths for alternative policy strategies

Outcomes are markedly different when we consider the forward-looking AIT strategy, which moves inflation closer to its target while preventing unemployment from climbing as high. Average inflation from 2009 through 2011 under the baseline policy is 1.6%; the forward-looking AIT scenario pushes that average up to 2.1%, rising as much as a full percentage point above the baseline level in one period. In terms of unemployment, the average for 2009-11 with the baseline strategy is 9.2%, but it drops to 8.4% on average with the forward-looking AIT strategy, falling as much as 1.2 percentage points in one period. These are substantial improvements in outcomes.

Like any empirical model, there is some uncertainty about the estimates and how large or persistent the economic disturbances were in this period. I compared the effectiveness of these policy strategies and found that forward-looking AIT reduces the uncertainty of outcomes substantially. The average range of inflation estimates in 2009–11 is 3.2 percentage points for the baseline policy, but only 1.1 percentage point in the case of forward-looking AIT. For unemployment, the baseline average range is 4.7 percentage points, and only 1.4 percentage point for AIT.

The key reason for such a large reduction in uncertainty about outcomes is that forward-looking AIT can substantially mitigate the effects of the ZLB constraint on monetary policy. The ZLB constraint usually leads to an uneven distribution of risks because nominal interest rates are generally unable to fall below zero; this effectively means that inflation will be weaker and less likely to climb, and unemployment will be higher and less likely to fall. The AIT strategy mitigates this asymmetric risk by avoiding the worst possible outcomes, thus making the ZLB more manageable.

Why is forward-looking AIT so effective after 2008?

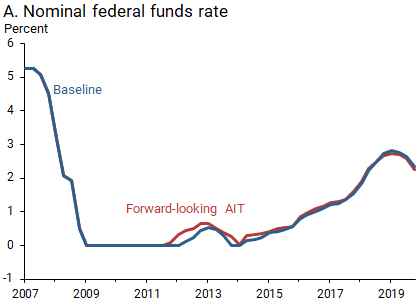

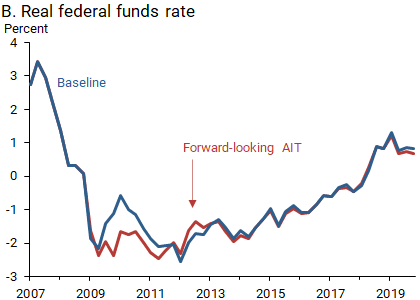

Another way to understand the potential benefits of AIT is by considering how it might have affected the ability to raise the federal funds rate sooner following the financial crisis. Figure 2 shows the simulated paths for both the nominal fed funds rate (panel A) and the inflation-adjusted real fed funds rate based on forecasts (panel B). The latter is a better measure of the actual stimulus to the economy.

Figure 2

Simulated paths of nominal and real federal funds rates for alternative policy strategies

Even with the nominal fed funds rate stuck at the zero lower bound, using the forward-looking AIT strategy can shift inflation expectations up. This can bring down the real fed funds rate as much as a full percentage point, thus providing additional accommodation even at the ZLB. That is what pushes actual inflation up and unemployment down in Figure 1.

One noticeable element from Figure 2 is that, with forward-looking AIT (red lines), the nominal fed funds rate in panel A lifts from the ZLB earlier than in the baseline policy estimates (blue lines). This can be somewhat counterintuitive because it is arguably more effective for the fed funds rate to stay lower for a longer period of time than what the baseline rule would imply, due to the ZLB. In this case, the AIT rule does not imply that the fed funds rate will stay at the ZLB longer. This is because of how successful AIT can be: if forward-looking AIT is credible and expected to stay in place through the near future, then households and firms adjust their expectations about the economic outlook in response to the expected more accommodative stance. As a result, both current and expected inflation are higher, and thus the fed funds rate lifts off from the ZLB a little earlier. In other words, if we looked only at the direct impact of inflation on policy, then the fed funds rate should stay low for a longer time. However, once we account for the feedback effects from policy to the economy, and back to the fed funds rate, that is no longer the case.

Conclusion

In 2020 the Federal Reserve incorporated average inflation targeting into its policy framework, which in theory can mitigate the adverse economic effects of the lower bound constraint on monetary policy. This Letter shows model-based empirical evidence that an AIT strategy that responds to both current and expected future inflation could have achieved substantially better economic outcomes and reduced uncertainty in the aftermath of the Global Financial Crisis.

Vasco Cúrdia is a research advisor in the Economic Research Department of the Federal Reserve Bank of San Francisco.

References

Ajello, Andrea, Isabel Cairó, Vasco Cúrdia, Thomas A. Lubik, and Albert Queralto. 2020. “Monetary Policy Tradeoffs and the Federal Reserve’s Dual Mandate.” Federal Reserve Board, Finance and Economics Discussion Series 2020-66.

Board of Governors of the Federal Reserve System. 2020. “Statement on Longer-Run Goals and Monetary Policy Strategy.” August 27.

Christensen, Jens H.E., and Glenn D. Rudebusch. 2012. “The Response of Interest Rates to U.S. and U.K. Quantitative Easing.” The Economic Journal 122, pp. F385–F414.

Mertens, Thomas, and John C. Williams. 2019. “Monetary Policy Frameworks and the Effective Lower Bound on Interest Rates.” American Economic Review Papers and Proceedings 109, pp. 427–432.