More than half of the world’s children are growing up in cities. By 2030, up to 60 percent of the world’s urban population will be under 18 years old. Yet, children and families are often invisible to urban planners, developers, and architects when creating city-wide policies that impact transportation, air and noise pollution, and health and well-being. “The truth is that the vast majority of urban planning decisions and projects take no account of their potential impact on children and make no effort to seek children’s views…All too often, this is down to a simple lack of respect for children’s rights or abilities,” writes Tim Gill in his recent book “Urban Playground.”

A critical component of child-friendly urban planning is prioritizing opportunities for learning and healthy development both in and out of school. This is especially important for children living in communities challenged by decades of discrimination and disinvestment. Deep inequalities plague the education systems in many countries, and the COVID-19 pandemic has widened existing educational equity in worrisome ways. In the U.S., persistent economic disparities among families lead to large differences in educational outcomes. Research shows that as early as age 3, children from lower-income households lag behind their more affluent peers in language and spatial skills.

To address both of these needs, cities around the world are beginning to invest in Playful Learning Landscapes (PLL)—installations and programming that promote children and families’ learning through play in the public realm. The climate for building on this momentum could not be more favorable, or the timing more urgent. In the wake of COVID-19, growing numbers of leaders understand the need to rethink neighborhood investments to enhance health, well-being, and economic opportunity—and to reexamine old views on how and where children develop the competencies and skills needed to thrive—and ask how to build on a community’s fund of knowledge to reduce inequities through culturally-informed spaces. In the U.S., these leaders have a once-in-a-generation chance to channel American Rescue Plan funds for innovations in child development and learning—while making cities more vibrant and inclusive.

As the PLL movement continues to grow, we need more expansive ways to measure its impacts, and to use that information both to improve PLL installations and to garner greater investment in them.

We know from existing installations that PLL is effective at enhancing STEM and literacy skills and increasing child-caregiver interaction in ways that build social and mental capitol. But as the PLL movement continues to grow, we need more expansive ways to measure its impacts, and to use that information both to improve PLL installations and to garner greater investment in them. This brief presents the first iteration of a new metrics framework city-level policymakers, community organizations, the private sector, and philanthropies can use to help assess the positive effects of PLL on learning outcomes, as well as its potential to enhance social interaction and public life in revitalized spaces.

A new approach to child-friendly urban design: Playful Learning Landscapes

PLL is an emerging, interdisciplinary area of study and practice that reimagines the potential of cities as supportive ecosystems for children and families by marrying urban design and placemaking with the science of learning. The Brookings Institution, in collaboration with Temple University and the Playful Learning Landscapes Action Network (PLLAN), is building an interdisciplinary community of practice and responding to the growing interest of stakeholders and decisionmakers around the world to generate evidence and guidance for scaling the PLL approach.

PLL uses human-centered co-design to create learning opportunities in bus stops, parks, and supermarkets and other everyday places—transforming them into enriching, social spaces for children, families, and communities. What makes PLL unique is the critical element of playful learning—a spectrum of child-directed play methods that include free play (no direct adult involvement), guided play (supported by adults toward a learning goal), and games (rule-based activities with learning goals) informed by the latest findings in developmental science. Guided play—the focus of interactions in PLL—allows children to maintain agency during their play with the guidance of an adult to provide structure and focus the activity around a learning goal (e.g., a well-curated exhibit in a children’s museum).

Scaling playful learning in cities

A growing number of cities around the world—including Philadelphia, Chicago, Santa Ana, CA, London, Mumbai, and others—are embracing PLL to support children’s learning outcomes and promote urban renewal, but efforts to scale and sustain these interventions are nascent. To fully realize the potential benefits of PLL, cities need more than a handful of installations placed sporadically around the landscape. To get to scale, municipalities instead must start infusing playful learning principles and design elements into the mainstream practices of government, businesses, and other organizations.

To this end, last year we outlined the steps city-level decisionmakers and stakeholders must take to create rich playful learning environments. These include fostering better coordination among city agencies to support the integration of playful learning efforts into new and existing programs and projects, streamlining regulatory and other processes to make it easier for nonprofits and other groups to implement PLL installations and activities, and collaborating with national organizations that are supporting local efforts. Scaling also requires engaging with neighborhood residents as equal partners in all phases of a project to ensure that designs meet their needs and preferences and communicating the why and how of playful learning to expand its reach and impact.

Brookings now seeks to address key gaps in cities’ knowledge, networks, and capacity and inform strategies that integrate PLL into mainstream urban planning and placemaking—bringing it to scale.

For city leaders, community organizations, the private sector, and philanthropy to put time and resources into expanding PLL, they need hard evidence that it works. This requires a framework that outlines the desired outcomes of PLL and a set of metrics for measuring whether or not those outcomes are achieved.

Measuring Playful Learning Landscapes outcomes

For city leaders, community organizations, the private sector, and philanthropy to put time and resources into expanding PLL, they need hard evidence that it works. This requires a framework that outlines the desired outcomes of PLL and a set of metrics for measuring whether or not those outcomes are achieved. As Senior Fellow Jenny Perlman-Robinson wrote in a Brookings report on PLL in Philadelphia, “Without clarity about definitions of success or without clearly defined metrics for measuring outcomes, it will be challenging to motivate and inform change at large scale.” Moreover, more robust evaluation will help communities know if individual PLL sites are working as intended, which will inform improvements to current as well as future sites.

There is now ample evidence that PLL supports several learning goals. For example, existing research shows that PLL promotes the kinds of caregiver-child behaviors and interactions directly related to later progress in social, STEM and literacy skills. Aside from these learning outcomes, we also must build on what we know about the benefits of public space investments to better understand how PLL installations can help improve the public realm, provide new opportunities for social interaction, and contribute to community cohesion (Box 1).

To advance this knowledge, Brookings and its partners have developed a framework and an initial set of indicators from both learning science and placemaking perspectives to define success criteria. Our “Playful Learning Landscapes metrics framework” will help evaluate the impact of pilot projects and guide iteration, scaling, and adaptation of PLL to future sites.

Box 1. Community engagement is critical for fostering PLL outcomesThe PLL metrics framework focuses on potential outcomes of playful learning spaces in the public realm. Philadelphia, Chicago, Santa Ana and other cities demonstrate that co-designing PLL prototypes with the community is required to reach these outcomes. For example, researchers worked closely with community members in Philadelphia to design and place the installations in Urban Thinkscape. Researchers also recruited and trained neighborhood members to be data collectors in response to requests from community members for more employment opportunities for neighborhood residents, and more ways to be involved in—and have greater ownership of—the process. In Santa Ana, researchers worked with mothers in the community to co-design signage that promotes caregiver-child interactions in the supermarket. Signs in the produce section with questions like, “How do you find the best fruit or vegetable?” and “What senses do you use to find the best one?” reflect stories that the mothers told about passed-down techniques for picking a ripe avocado or papaya. These signs promote sharing cultural traditions passed down from one generation to the next and encourage children to make observations and test hypotheses—both important skills for learning science later. |

Playful Learning Landscapes metrics framework

Our work to create a PLL metrics framework began with a landscape analysis to survey existing frameworks and tools around measurement and evaluation of playful learning in cities. To create goals and metrics from the child development perspective, we turned to the rich and growing body of research that demonstrates PLL increases caregivers’ attitudes about the connection between play and learning, promotes the kinds of caregiver-child communication that support relationship building and language learning, and encourages talk about numbers, letters, and spatial relations.

In addition, three placemaking and urban design frameworks inspired and helped shape our approach and selected metrics.

- The Place Diagram (Project for Public Spaces (PPS)): Through their work evaluating public spaces across the world, PPS identified four qualities of successful public spaces: (1) The spaces are accessible; (2) people engage in a range of activities there; (3) the space has a positive image and is comfortable; and (4) it is sociable and welcoming. The framework also prompts the user to ask key questions in assessing each of the qualities. For example, asking “Do sidewalks lead to and from the adjacent areas?” or “Does the space function for people with special needs” to address accessibility.

- KaBOOM! Play Everywhere: Understanding Impact (Gehl): To examine the impact of KaBOOM!’s Play Everywhere initiative—implemented across 50 U.S. cities—Gehl used a multimethod approach including on-site observations, interviews with stakeholders, and intercept and neighborhood surveys to understand who visits the sites, what they do when visiting, and how they feel about the sites. Through this work, Gehl identified four key components of a successful Play Everywhere project: (1) proximity to existing kid “hubs” (where families live and spend time); (2) incorporation of kids’ perspectives into the design and implementation process early and often; (3) prioritization of interactive designs that spark curiosity and imagination; and (4) messaging that it’s okay to play in many different spaces (e.g., at the bus stop or on the sidewalk).

- Measuring the Civic Commons (Reimagining the Civic Commons): Reimagining the Civic Commons designed a measurement system to examine the impact of investments in public spaces and the surrounding communities towards four key goals: civic engagement, socioeconomic mixing, environmental sustainability, and value creation. Within each goal are “signals”—indicators associated with a project’s objectives, and each of those signals has a set of metrics designed to understand changes such as average hourly visitorship of the site, number of trees in civic commons sites, and percent of respondents who say they feel safe in the neighborhood.

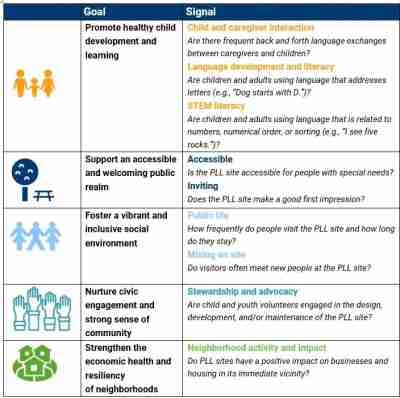

While the resources described above were all instrumental in shaping the development of our metrics framework, we adopted the approach of mapping metrics to signals and the signals in turn to goals (inspired by the Measuring the Civic Commons framework) because it allowed us to integrate both the child development and placemaking perspectives of PLL into one framework (Box 2). Our metrics framework has the following five goals:

- Promote healthy child development and learning: Sparks playful and meaningful experiences that support child-caregiver interactions known to promote cognitive and social-emotional learning and positive development.

- Support an accessible and welcoming public realm: Offers a physical space that is easy and convenient to access, feels safe and inviting to visitors, and reflects community cultures and values.

- Foster a vibrant and inclusive social environment: Cultivates an engaging public realm that promotes social interaction among children and adults of all incomes and backgrounds.

- Nurture civic engagement and strong sense of community: Builds neighborhood pride and community cohesion through the cocreation and ongoing oversight of PLL sites.

- Strengthen the economic health and resiliency of neighborhoods: Has a positive impact on the surrounding community, including local businesses, property owners, and residents.

Box 2. PLL metrics framework at a glance

Note: The full framework can be found here.

Challenges and next steps

The “Playful Learning Landscapes metrics framework” is a key step toward generating data that are critical for scaling by helping to define the desired outcomes of playful learning in public and shared spaces, and importantly, how they are measured. But measuring the impact of public spaces isn’t easy—getting the metrics “right” is likely to be an ongoing effort, and data collection itself is often messy and time intensive. Our framework employs a range of qualitative methods including observation, intercept, and neighborhood surveys, each of which can be difficult to design and employ, especially in communities where trust in local government is low and residents may be wary of interacting with outsiders.

As the PLL movement gains momentum, generating evidence to demonstrate its impact will be key to strengthening the field and shifting mindsets among key stakeholders and city-level decisionmakers to weave playful learning into the fabric of city policies.

In the next phase of work, Brookings—together with its partners—will pilot the PLL metrics framework to explore research questions such as:

- Are changes in caregiver and/or child attitudes and behaviors toward play and learning sustained after the initial exposure to PLL installations? In the future, we will want to measure the possible child development and learning effects that are prompted after visiting a PLL site (for example, at home or in other environments).

- Do multiple PLL installations in the same neighborhood lead to broad-based impacts at various geographic scales? The current framework focuses on outcomes at the individual site level. As more installations are built across cities in the U.S. and globally, we hypothesize that PLL will yield more expansive neighborhood and community outcomes. Data from The Ultimate Block Party—the first PLL pilot—suggest that caregivers’ attitudes about the play-learning connection can be shaped in a community setting. These broader outcomes will be important to measure as a step toward sustainable uptake of PLL approaches.

- What are the most effective methods for collecting data to maximize the quality of feedback? As described in Box 1, engaging community members to collect data can help in increasing response rates and improving the quality of feedback, but collecting survey data at PLL pilot sites will be challenging.

As the PLL movement gains momentum, generating evidence to demonstrate its impact will be key to strengthening the field and shifting mindsets among key stakeholders and city-level decisionmakers to weave playful learning into the fabric of city policies. The PLL metrics framework provides a roadmap to collect data that demonstrates PLL’s tremendous potential to narrow opportunity gaps while creating more livable and playful cities. The framework will continue to evolve as we learn from communities that are testing the expansion and adaptation of PLL on a neighborhood- and/or city-wide level. Rather than an end point, the framework provides a starting point for thinking about PLL’s goals and how to understand—and communicate—if and how sites are achieving them. This important work is just beginning.