Abstract

Access to electronic financial services, in particular digital money, has replaced the digital divide as an unintended yet significant barrier for low-income individuals to participate in new technologies, including those that lead to better health outcomes. This paper explores this problem in depth. It begins by describing and documenting the barriers, costs, and benefits to accessing and using digital money. Next, the paper turns to implications of the broader technological revolution on the nature of money and payment systems. This includes an examination into the structure of our banking and payment systems and their overlay into different demographic groups of Americans. The paper then explores the ramifications of disparity in access to digital money for physical health including an analysis of how the COVID-19 pandemic amplified existing problems. It concludes with a set of recommendations to ameliorate the problems identified.

The paper finds that access to digital money is an underappreciated vector by which technological innovation, both financial and non-financial, can be hindered in reaching certain populations. Accessing digital money is easy and free for those with money while for those without a lot of money, digital money is expensive. Digital money’s role as a barrier to accessing new technology, particularly in an app/mobile/online economy, will likely exacerbate existing inequalities and impede adoption of some new technology for lower-income people. To the extent that these new technologies offer health benefits and require digital money, existing public health inequalities will be exacerbated. Fully realizing the potential health and wealth benefits of new technology requires a better solution to the digital payment divide than currently exists.

Key Findings

America’s payment system is designed to segregate people by income and wealth. Access to digital payments is more expensive and difficult to obtain for lower-income households and racial minorities despite decades of continuing growth of usage of digital money. This results in barriers to adoption of new technology, which increasingly requires digital payments. The response to the COVID-19 pandemic exposed several consequences of this problem, resulting in reduced effectiveness of pandemic response and potentially greater health risks due to a lack of access to digital payments.

Linkages between income, wealth, and physical and mental health have been documented. However, prior research has not generally considered the role of payments and access to digital money as impacting either income or health. This paper argues that access to digital money has a direct impact on financial well-being and consequently should factor into determinants of health. In addition, the inability to access digital money easily and cheaply may factor into other elements that have been studied as part of the broader social determinants of health, specifically the ability to access new technologies that require digital payments.

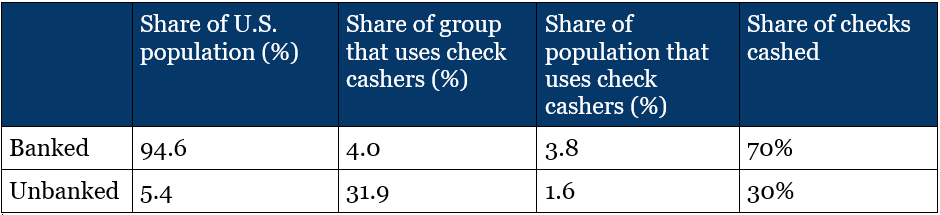

A specific new finding in the paper is that the majority of Americans who use check cashers and the majority of checks cashed are from people with bank accounts. This challenges the notion that being “unbanked” drives use of certain “fringe financial services” such as check cashers. Issues around cost, including the value of immediate payment, drive decisions on how best to access money, whether through bank products or non-bank products.

Table 1: Use of check cashing services, by banking status

The main policy solutions discussed center on enhancing access to digital payments through expansions of the provision of low-cost financial services. The goal is universal access to digital payments at low/no-cost, which should reduce the inequality effects of new technology. A set of policy solutions are being discussed, but more analysis is needed to ensure that proposed solutions correctly identify and address the key challenges, which are primarily centered around cost and timeliness rather than physical locations, hours of operation, or the creation of new forms of digital currency. Inaction in solving these problems intensifies inequality, hampers responses to future pandemics, and reduces the efficacy of other solutions designed to improve public health. The status quo is not static. Technology continues to develop. Absent substantial reform of our nation’s banking and payment systems that lower the cost of accessing and transacting in digital money, millions of Americans will be unable to fully benefit from technological advancement, and that is likely to have health consequences.

Download the full report here.

Related Content

This report was funded by a grant from the Robert Wood Johnson Foundation. The Brookings Institution is financed through the support of a diverse array of foundations, corporations, governments, individuals, as well as an endowment. A list of donors can be found in our annual reports published online here. The findings, interpretations, and conclusions in this report are solely those of its author(s) and are not influenced by any donation.