There is only one ball, so you need to have it.

– Johan Cruyff

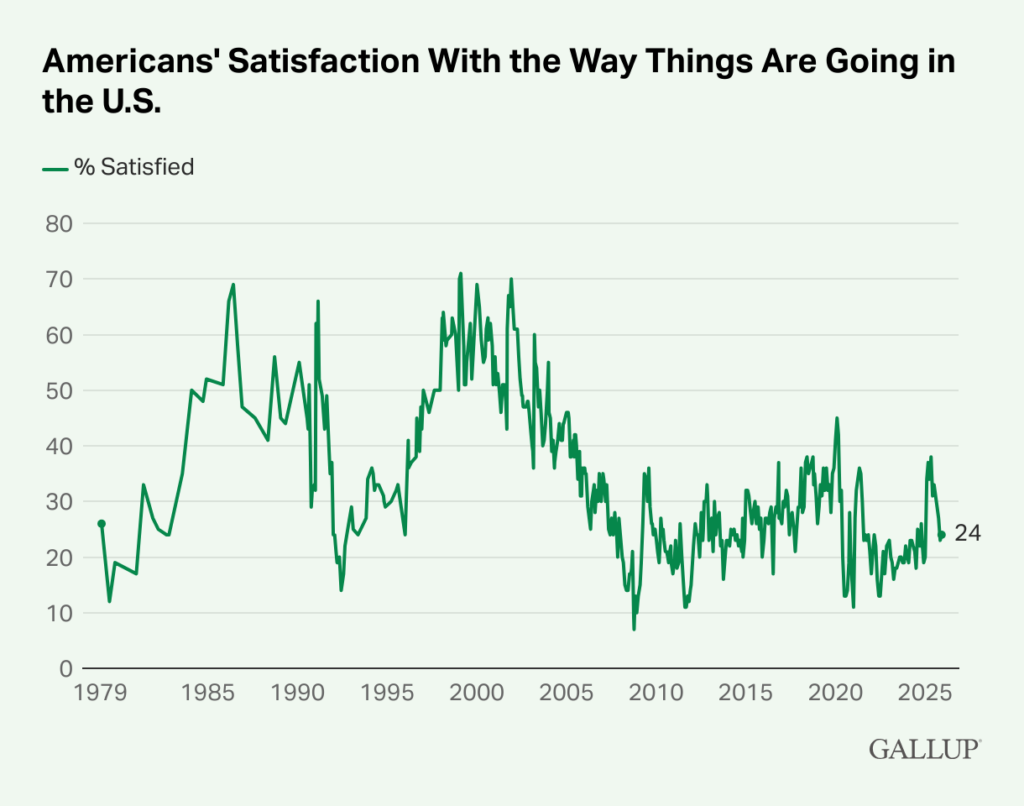

The ‘reflation' trade of recent weeks in a nutshell…

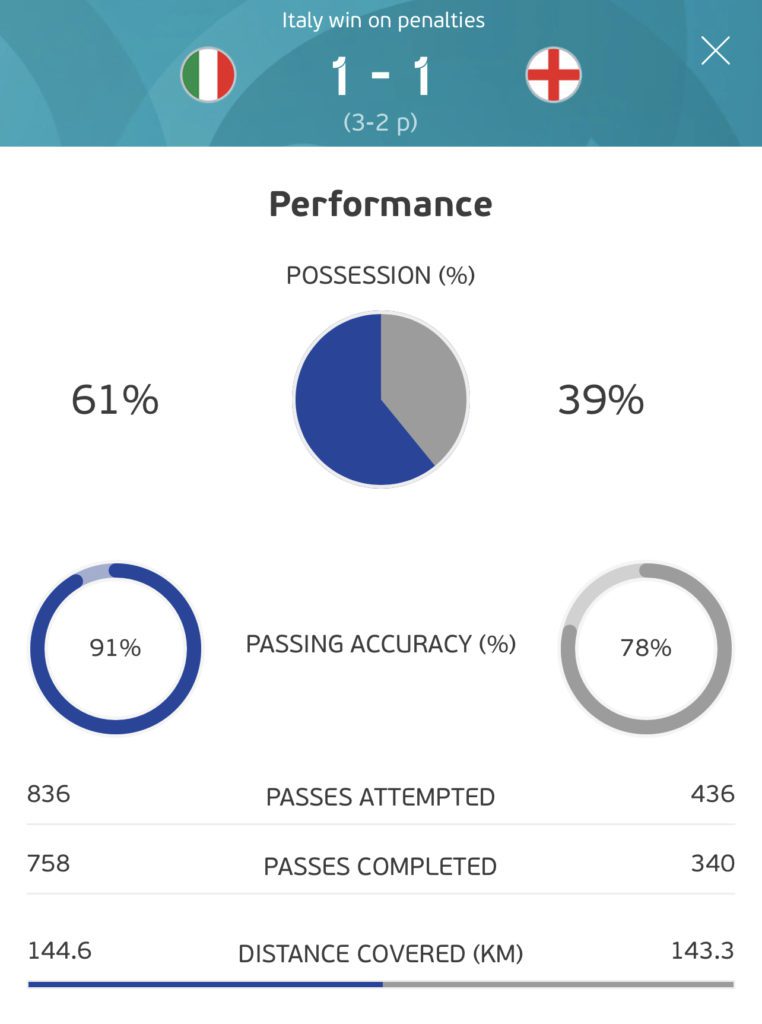

Euro 2020 Final analysis – Italy vs England

It went to Rome! The match stats over the 120 minutes played tells us England coach (Gareth Southgate) and players did well

to take the game to a penalty shootout. And, it almost paid off!

To state the obvious, superior ball possession and accurate passing against the opponent are a prerequisite to any game plan. Based on publicly available data, sports betting modellers agree (almost) 100% with the choice and ordering of the penalty takers of both teams.

You do the best with the players at your disposal. Southgate did just that. Well done England, congrats to the Azzurri, and roll on Qatar 2022!

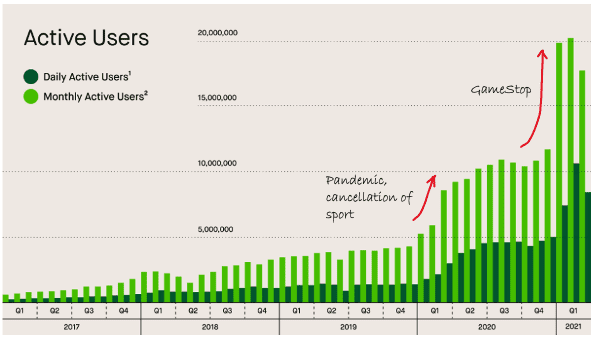

Robinhood IPO

What is Robinhood?

Plus: Buy Now Pay Later, M&A, Weather

“Robinhood customers are sitting on $25 billion of gains ($1,400 per account) and that ‘house money’ may sustain activity for some time. But when it’s gone, trading may lose its allure and Robinhood’s growth will have peaked.”

Former star hedge fund manager Marc Rubinstein wrote in a recent blog post that the best days of Robinhood are now behind us. He highlights a recent decline in user growth with comparisons to established competitors: Charles Schwab and ETrade.

Autonomous Research clients will find a useful 90 page Primer on Robinhood by the firm. You can contact us for a direct email introduction to receive the report.

Our take on Robinhood

Few industry insiders are excited by the Robinhood IPO… after all, it is just another online broker founded upon a lax regulatory regime. The product design could only come from founders who were industry outsiders.

Through the lens of established industry professionals, there is little to get excited about in Robinhood – yet another sign of frothy markets.

The people at Robinhood would say the financial services industry has (in aggregate) consistently failed to deliver value to investors, and missed the rise in retail trading and digital payments. Regulation has protected traditional finance more than hindered their ability to innovate.

What most analysis on Robinhood miss

- The ability to identify a large opportunity, and deliver triple digit growth, in what industry experts saw as a saturated market. i.e. Serving the underserved.

- Retail customers desire a simple-to-use trading platform with educational content over more advanced charting tools which are used only by a minority of seasoned professionals.

- Know Your Customer (KYC) is about hands on data analytics, not a business function that is outsourced to compliance departments.

- The growth potential outside of the US capital markets.

Whilst many copycat competitors are fast emerging, Robinhood enjoys a significant first mover advantage. We believe the Robinhood phenomenon, and rise of retail investors, is here to stay. With the slight exception of JP Morgan and Citadel Securities, most Wall Street firms continue to miss out on this opportunity.

Our (Speevr's) firsthand experience suggests a new underserved group of market participants that have emerged in recent months. As they grow in experience, they seek the usual complimentary services to trade execution. Notably, access to timely, reliable, and comprehensible market information/knowledge. This also holds true for seasoned market professionals.

In summary, Robinhood is like most other Silicon Valley startups at IPO – a rich day 1 long-term bet on the best in class to continue to grow and innovate into new lines of business.

Three Macro Themes Repricing Assets And Driving Economic Growth