SOM Macro Strategies

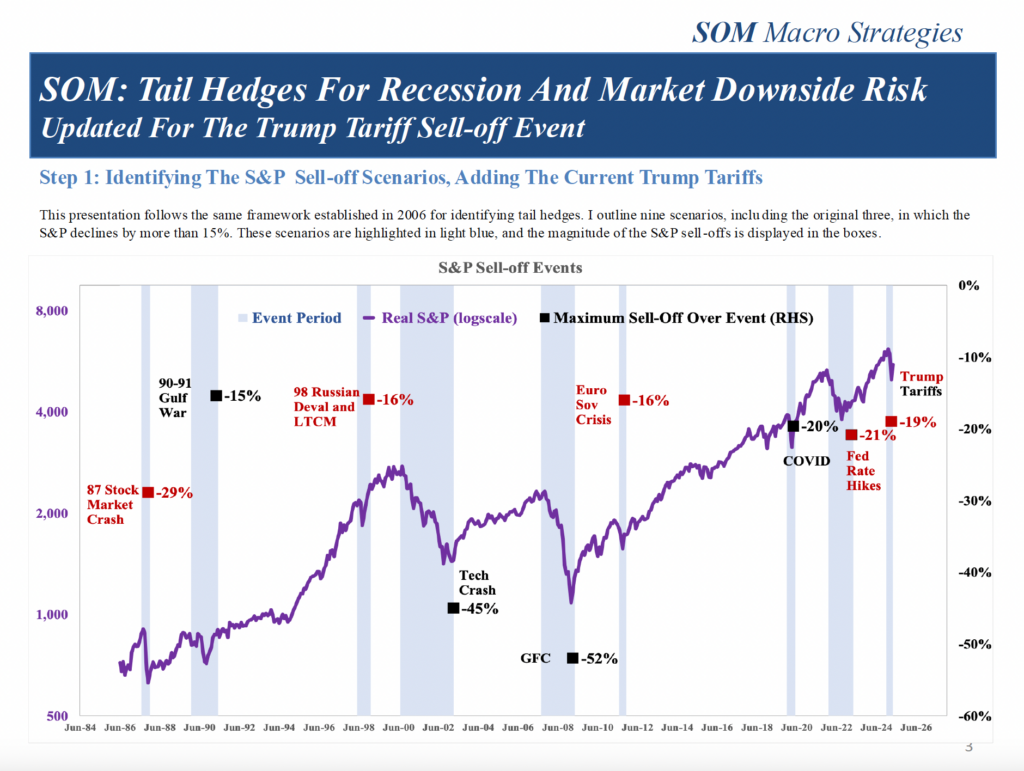

SOM Macro Strategies was founded by former Goldman Sachs strategist Alan Brazil after leaving the firm to independently publish his State Of the Market (SOM) reports. The SOM reports reflect the results of fundamental economic analysis of macro themes that are likely to reprice across asset types and markets. This framework helps to identify strategies that provide investors with asymmetric returns with high expected Sharpe ratios.

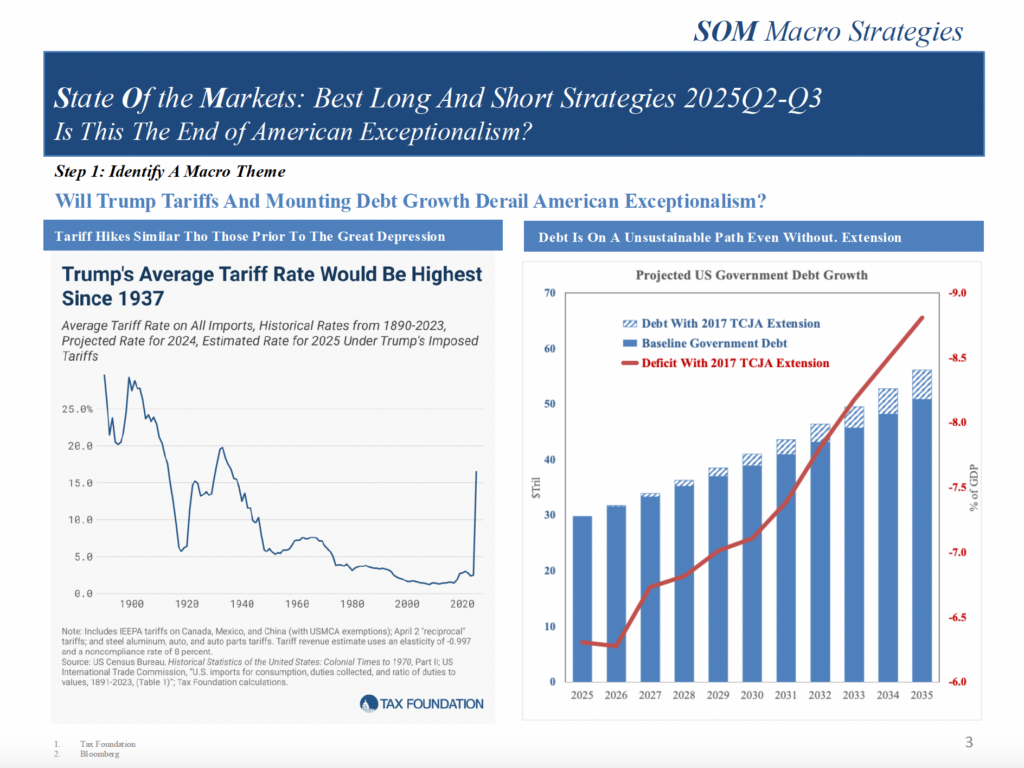

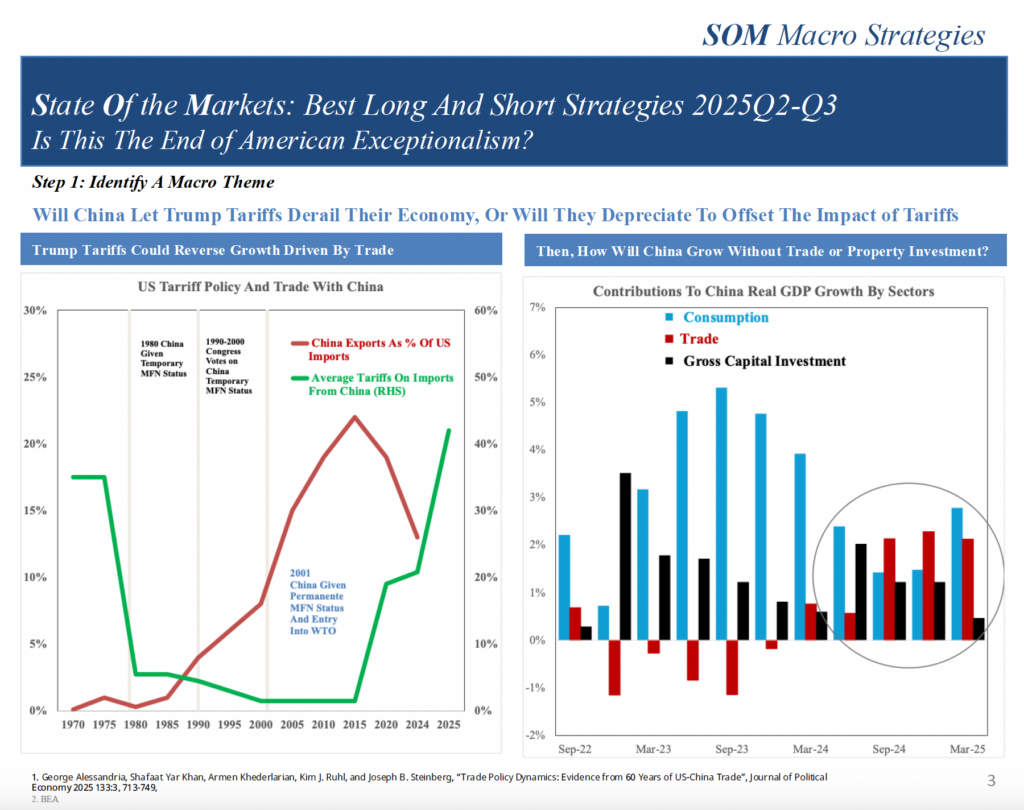

SOM | Is This The End of American Exceptionalism?