SURVEY RESULTS: 116 anonymous respondents predominantly financial market professionals.

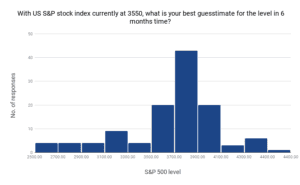

1) “With US S&P stock index currently at 3550, what is your best guesstimate for the level in 6 months time?”

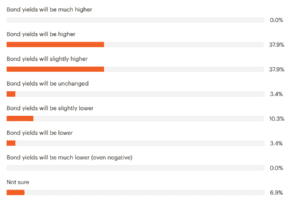

2) “If Global GDP in 2021 is around 5-6% as most economists project, what will be the likely impact on US 10 years bond yields? (Using the current 10 year rate of 0.92% as your reference)”

Comment: Current consensus estimates for 2021 Global GDP by sell-side economists are around 3-4% with Goldman Sachs an outlier with an additional +2% contribution due to rapid advances in vaccine development. Apologies for this mistake.

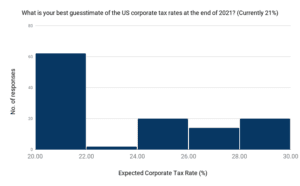

3) “What is your best guesstimate of the US corporate tax rates at the end of 2021? (Currently 21%)”

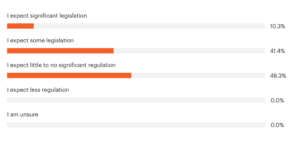

4) “How much legislation do you expect to be passed in Congress within the next 1-2 years to regulate the tech giants? Specifically, Apple, Amazon, Google and Facebook.”

Comment: Everyone seems to have a view here.

5) “What industry do you work in?”

Over 90% of our responses came from financial industry professionals, 6% from the tech sector, and the rest from others. Winning response was “Flipping Bonds”. Please make yourselves known to a syndicate desk for a bonus new issue allocation.

To summarize: Most survey participants expect the stock market to be higher within 6 months and Treasury bond yields higher (prices lower). Roughly half expect US corporate tax to remain at 21% at the end of 2021, and the other half expect them to go up between 25-29%. Similarly, on tech regulation half of the respondents expect little to significant change, with 10% expecting significant legislation (all within the financial services).

SOM | Is This The End of American Exceptionalism?