Step 1: Macro Theme: The Case For Residential Mortgage REITs

– Residential mortgage REITs are cheap because they represent buying Resi assets at distressed levels at a discount

- Step 2: Fundamental Economic Framework

- – Sell-off in residential mortgage REITs have followed the sell-off in the entire mREIT market

- – Sell-off in residential mortgage REITs reflects the impact of the dislocation in the underlying resi assets and the resulting margin calls during the last week of March

- REITs are a leverage strategy with leverage funded with short-term repo

- Sell-offs in the underlying resi assets driven by historical widening of spreads drove margin calls across the business models of the REIT

- All REITs delveraged, reduced repo lines, and raised cash

- – Risk across their business models have subsided

- Step 3: Identify Potential Repricing Events

- – Residential REIT pricing should improve as the headwinds abate, and reflect the improvement in the underlying asset values

- – Leveraging agency pass-throughs offers mid-to high ROEs, while the Fed has reduced repo funding pressures on REITs and given a strong bid for agency pass-throughs

- – Non-agency credit assets offer double digit yields because the market is pricing in an unrealistic repeat of the GFC HPA/default cycle

- HPA is unlikely to fall as much given the improvements in the underlying housing market versus the years prior to the GFC

- Mortgage underwriting has tightened, particularly in the reduction of closed-end seconds (CES), e.g. silent second

- Defaults projections are biased upwards reflecting the impact of silent seconds: e.g. reported 80 LTV could perform like be a 100 CTV

- – Mortgage originations should accelerate offsetting the markdowns of MSRs

• Limit on 4 months for advances should help their servicing book

• Step 4: Find Asymmetric Trades

- – Trade 1: Buy residential mortgage REITs

- – Trade 2: Buy double-B and single-B agency CRT bonds

Continue to read on PDF

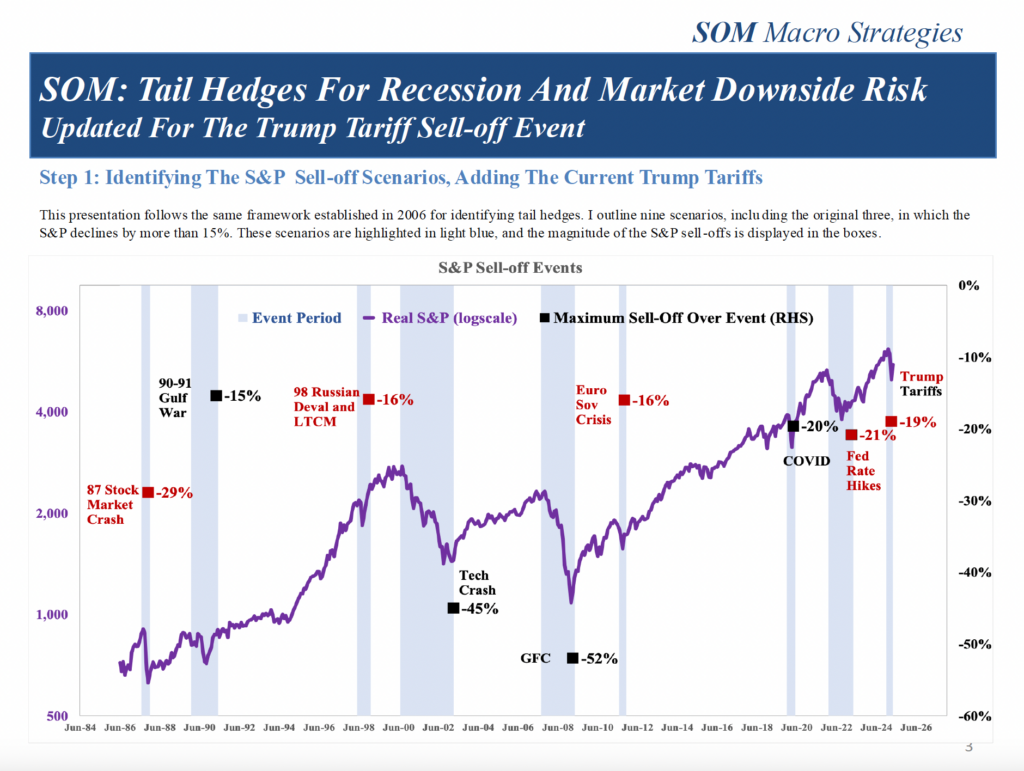

SOM Macro Strategies

SOM Macro Strategies was founded by former Goldman Sachs strategist Alan Brazil after leaving the firm to independently publish his State Of the Market (SOM) reports. The SOM reports reflect the results of fundamental economic analysis of macro themes that are likely to reprice across asset types and markets. This framework helps to identify strategies that provide investors with asymmetric returns with high expected Sharpe ratios.

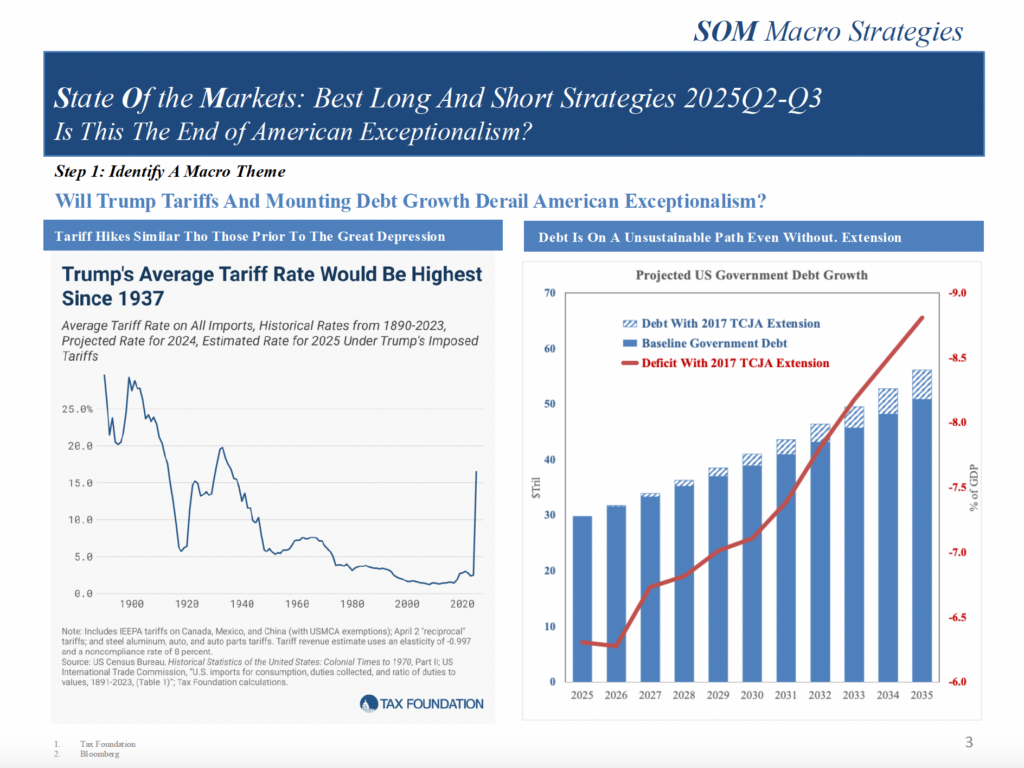

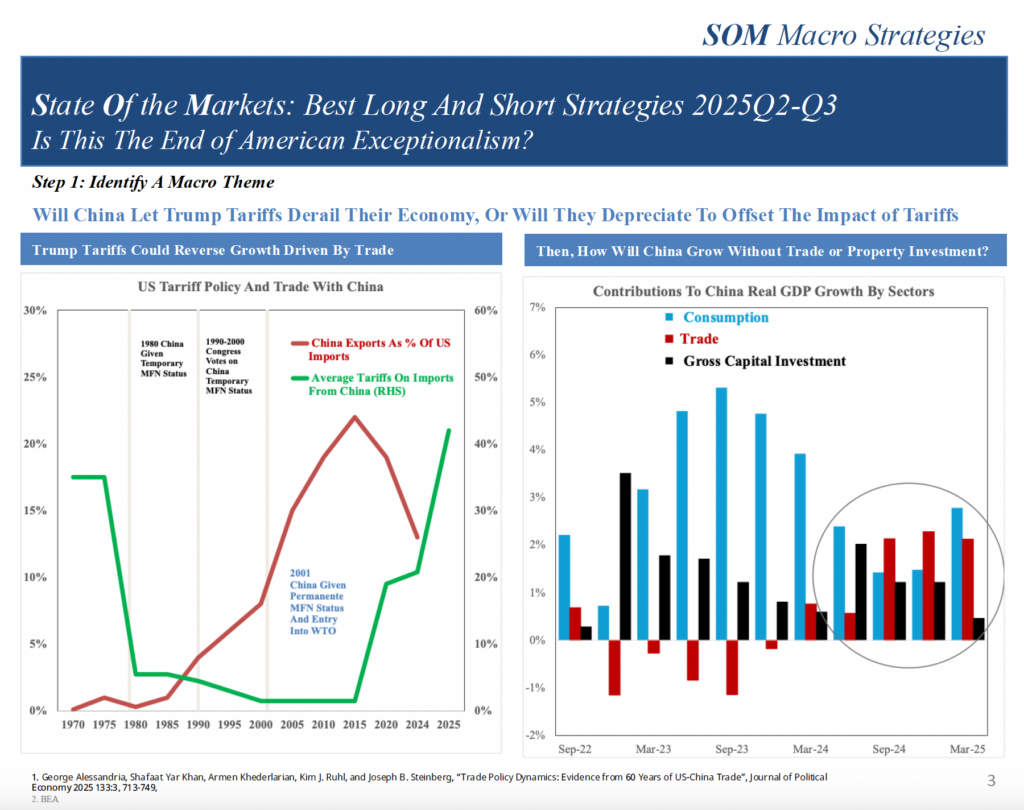

SOM | Is This The End of American Exceptionalism?